MODERATORS

4 stars based on

31 reviews

For most of the history of blockchain-based currencies and assets, the story has been all about Bitcoin. In roughly the past 12 months, the number of cryptocurrencies listed on CoinMarketCap. As counterparty vs ethereum crypto the June 4 snapshot, there were cryptocurrencies and other digital assets listed on the main CoinMarketCap page. Between January 3, — the first snapshot of — and June 5, counterparty vs ethereum crypto, the number of cryptographic assets listed on CoinMarketCap grew from toan increase of about counterparty vs ethereum crypto percent in almost exactly 18 months.

As the chart shows, the pace of growth in the number of crypto-backed assets is itself growing. Based only on the listings on CoinMarketCap, 80 percent of the growth in the number of cryptographic assets over the past 18 months took place since January 1, Bymost of the forks were off of Litecoinwhich is based on Scrypt. Remember the goofy, meme-based Dogecoin? That was a fork of Litecoin. The goal was to create cryptocurrencies as valuable, or at least as lucrative, in the short-run, as Bitcoin.

If the forkable, derivative-by-design nature of cryptocurrencies explains the breadth of the ecosystem, what explains the growth counterparty vs ethereum crypto value? Part of it is surely market speculation, and another part of it is that cryptocurrencies and other blockchain-based assets do have real-world applications today. But another part comes from cryptocurrency entrepreneurs wising up to the fact that their little upstart protocols, in order to be valuable, needed to have an ecosystem built around them.

That, of course, takes time and money. There are two ways of approaching this. Once their new cryptocurrency hit an exchange, and thus had a price, this private stash of coins would then have value, enough to sell for Bitcoin or fiat, which could then sustain a project until the ecosystem of wallets and services around their cryptocurrency became self-sustaining and community-driven.

Counterparty vs ethereum crypto, though, the fundraising mechanism of counterparty vs ethereum crypto appears to be the initial coin offering. As Alex Wilhelm explained in an article for TechCrunch:. Although the mechanics of ICOs have been in practice for several years, the name and label for initial coin offering events has only gained some currency recently.

And the ICO market has really hit a hockey-stick growth trajectory. Back then, early speculators in Bitcoin, flush with newfound crypto-fortune, plunged their money back into emerging cryptocurrencies. This was done partially for fun see Dogecoin and other novelties but also to chase the same kind of returns they enjoyed from Bitcoin investments.

For now, that bull run has continued unabated. What explains the price increase? Bitcoin is a relatively bare-bones blockchain system that requires layers of protocols to be built on top of it to make it a usable platform for utilities like smart contracts.

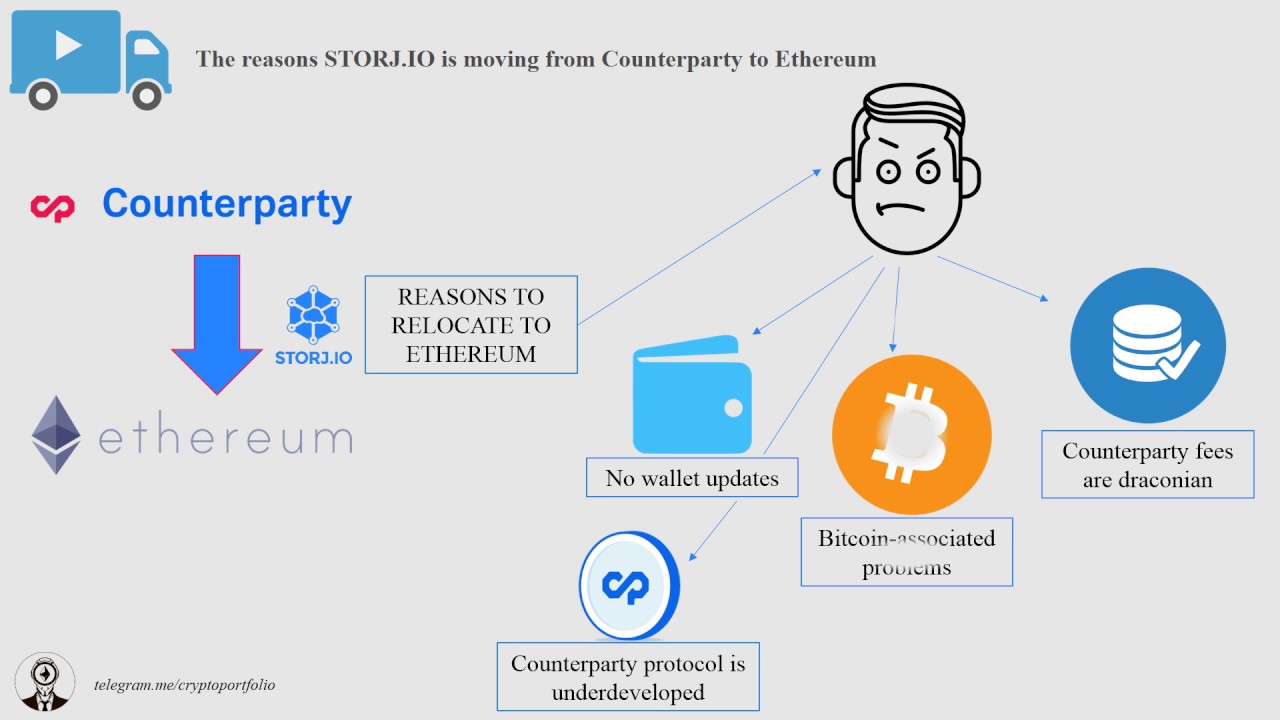

Platforms like Counterparty and Omni are both built on the Bitcoin blockchain and have sprouted their own collection of digital assets and services that ride on top of them. Ethereum, on the other hand, was launched with its own scripting language baked in, making it possible to build complex smart contracts, decentralized autonomous organizations DAOsdecentralized autonomous apps DApps and even other cryptocurrencies with relative ease. This ease of development, combined with the rising price of Ether and a desire by early stakeholders to re-invest in the Ethereum ecosystem, has made Ethereum the platform of choice for crypto-asset entrepreneurs — at least for now.

From zero percent of the monthly asset offerings less than a year ago, to more than half of all the closed or announced ICO events tracked on that page, the growth of Ethereum is impressive. The table lists names, blockchain platforms, market capitalizations and prices of some assets. Although roughly a third of the assets listed were built on Ethereum, just over three-quarters of the market value of all counterparty vs ethereum crypto these assets is tied up in assets built on top of the Ethereum platform.

This is roughly half of all the value attached to Ethereum-based assets and more than a third of all the market value of crypto-backed assets and tokens in general. The value counterparty vs ethereum crypto crypto-assets listed on CoinMarketCap is divided between those built on Omni and those built on Counterparty. Ethereum is the platform of choice because it offers a blockchain platform with a built-in abstraction layer, which serves to unify the ecosystem. Ethereum offers the tantalizing promise of one chain to rule them all, or at least counterparty vs ethereum crypto chain to act as the foundation.

Ether traders, entrepreneurs and developers alike are keen to let a thousand tokens, DApps and DAOs bloom because, although each of these assets is distinct, their roots run deep and ultimately back to Ethereum. Jason Rowley is a venture capital and technology reporter for Crunchbase News. More posts by this contributor What did VCs study in college?

Charting the adoption of direct startup investments by family offices.