Earn free bitcoin with bot

39 comments

Advertising network bitcoin wallet

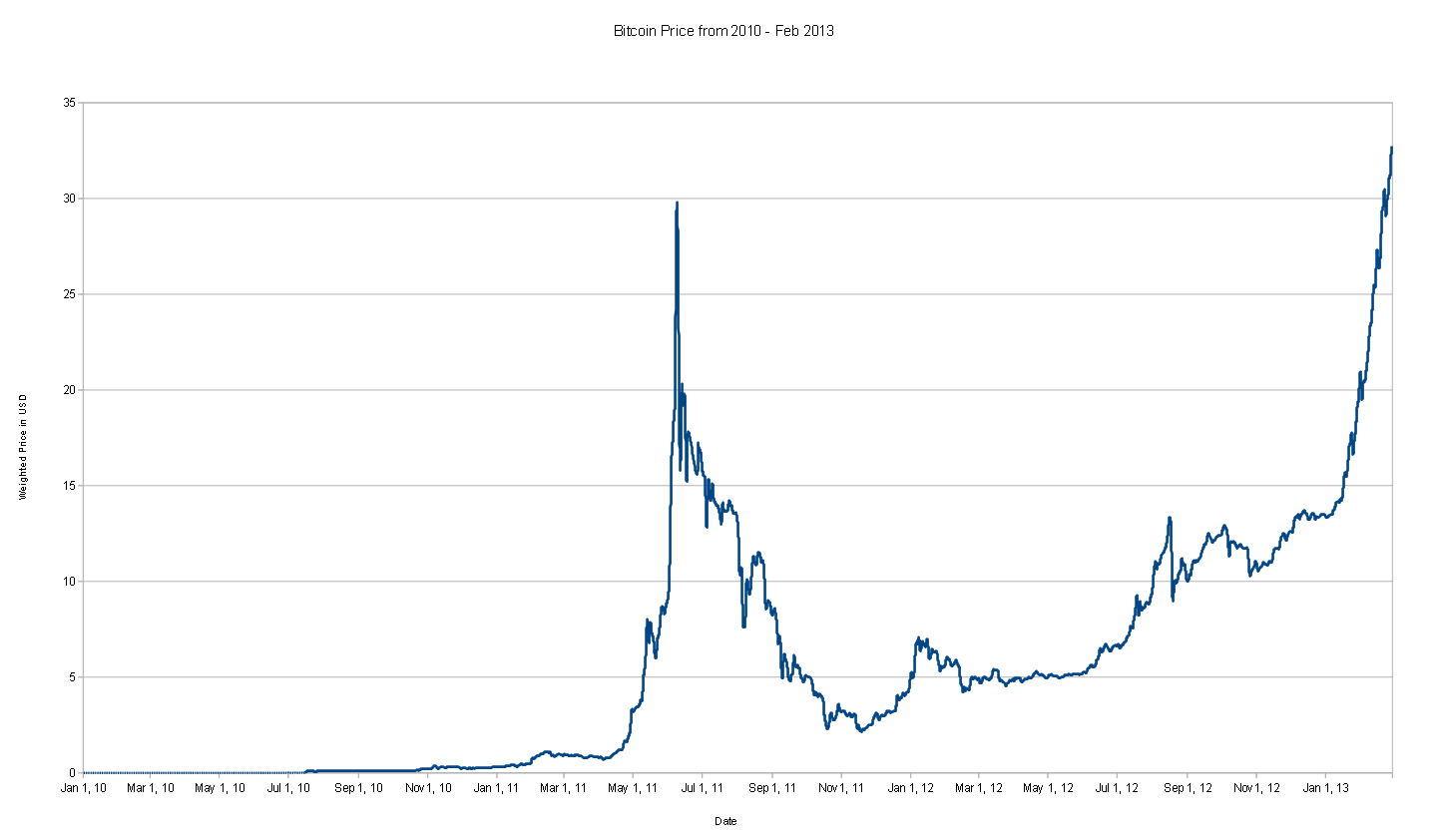

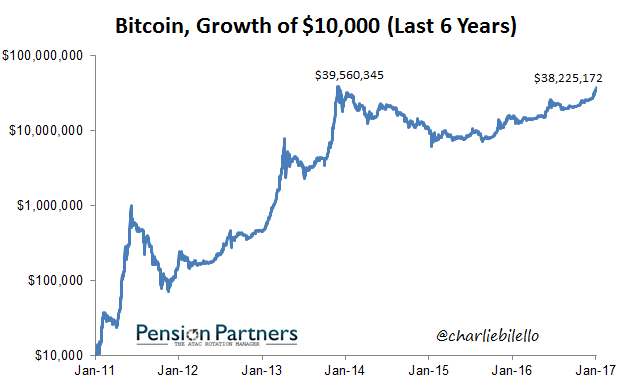

But is this a bubble? Are the gains real? And are the bitcoin whales in for a sad Christmas? First we must understand what drives bitcoin price and, in particular, this boom. The common understanding for current growth leads us back to institutional investors preparing for the forthcoming BTC futures exchanges.

The primary theory about the astonishing rally being put forward by investors on social media is that bitcoin will soon benefit from big institutional money injections via the introduction of the first BTC futures products.

This ability makes bitcoin far more palatable to big investors who are currently flooding the market to make profits if and when the bitcoin price falls. This group of enthusiasts bought and held bitcoin and will not sell it at any current price. More and more bitcoin fans are entering into this group and they are driving up demand increases. We see a common thread between these points: All cryptocurrency movements are based on domain specific media and conversations between traders.

Bitcoin traders, it can be said, are now akin to the jolly colonists selling stocks under buttonwood tree. That is all coming and at that point the market will harden itself against panics and booms. Until then we enjoy rises and dips and volatility that puts most bitcoin dilettantes off their lunch. Ultimately new and old users are testing the limits of a system that, for a decade, has been untested. The futures market will be a big driver in growth and bust over the next few months as institutional investors begin using the currency.

Yes, to those who are betting big on BTC. Again, I cannot tell you whether to buy or sell but the common expectation is that bitcoin raises to a set point and then fluctuates between a high and a low until the next run up. Many expect foul play. Now that Bitcoin futures are available it is easy to buy into futures market first and then create a massive number of buys or sells of Bitcoin to ensure the price swings in favour of your futures contract. Is this a bubble? Many are disappointed in the moves, believing the rise is happening because of market manipulation.

But we must remember that the real value of a cryptocurrency is not driven by price but instead is driven by utility. While bitcoin may always be the proverbial hidden pot of gold for early buyers the future of all cryptocurrencies is still being written. Just as, in , no one could have predicted the prevalence and value of open source projects like Linux and Apache, no one can currently predict what bitcoin and other cryptocurrencies will do for us in the future.