Litecoin wallet upgrade wind

39 comments

Bitcoin solo mining rpcuservices

Ongoing innovation creates opportunities to improve the general wellbeing of mankind but with the advent of new technologies also comes great challenges for nations and their citizens.

The South African National Treasury has cautioned the public to remain extremely vigilant of the risks and benefits which accompany cryptocurrencies. They evolve rapidly and have a number of attributes making them attractive as a payment method. These are the ability to instantaneously transcend national borders while providing anonymity and security due to high-level encryption.

Cryptocurrencies, therefore, present governments, institutions and law enforcement agencies with complicated challenges, having been linked, inter alia, to crimes related to financing for assassinations, corporate espionage, pornography, drugs and weapons.

While currently unregulated, this emerging technology is being carefully monitored and strict controls may be imposed at any moment due to its wild price fluctuations, potential for fraud, and undoubted potential for use by criminal elements.

However, despite the negative perception in some quarters, it is clear that cryptocurrencies and the block chain technology that underpins them provide a refined, efficient and adaptable peer-to-peer platform, which empowers the average citizen to deal with their finances without government and bank interference. In a recent World Economic Forum Report: The WEF has identified that the payment industry is undergoing a major revolution that has enormous implications for providers of payment services as well as the end-users of these services.

A cryptocurrency, such as Bitcoin, is a digital or virtual currency utilising encryption cryptography for security. A cryptocurrency is difficult to counterfeit because of this high-level security feature.

It operates on a peer-to-peer platform, meaning that transactions occur directly between users, without the need for a wider institutional framework ie, the bank.

Bitcoin is by its very nature international in scale, is more secure than previous electronic payment methods and carries within it protection against inflation https: All-in-all, Bitcoin is viewed by many as a superior payment mechanism.

At the same time, the viability and growth of these innovations have led to heightened concerns about their use, as they allow both legal and criminal users to transfer money nearly instantly across jurisdictions. Some governments are concerned that anonymised, peer-to-peer private payment systems will weaken measures to control the value of their own currencies, in the worst-case scenarios making them potentially vulnerable to catastrophic and unprecedented attack by speculators.

Naturally, uncontrolled anonymous outflow of value is also of grave concern to nation states. So far, however, in the United States there has been little attempt at regulation while the cryptocurrency is currently unregulated in South Africa SA.

Further, as a direct response to the failure to convict Espinoza, House Bill was recently passed in Florida, defining virtual currency and prohibiting its use in laundering criminal proceeds.

The resulting outcome is that criminals using cryptocurrencies will be charged with money laundering, as well as the underlying criminal activity. This trend is being followed in many US states and recent cases in the US mostly seem to accept a wider definition of money into which cryptocurrencies can fall, although divergent views still exist. As a payment mechanism a cryptocurrency can facilitate greater flexibility, efficiency, speed, widen operational reach and may reduce the costs associated with the conventional banking system.

They have no direct links to the laws, rules or regulations of any government, institution or bank. The interest rates, fees and charges usually payable on a traditional banking account current, savings, credit card, etc do not have any effect on the cryptocurrency.

The rate of inflation that can potentially diminish the purchasing power of government-issued currency cannot affect the value of cryptocurrency. Cryptocurrency provides its users with total anonymity, as opposed to traditional purchases with a debit or credit card where personal information attaches to each and every transaction.

It is now recognised internationally that businesses, banks and even governments utilise this information to track individuals and take note of purchases. In contrast, cryptocurrency transactions carry no personal information unless added by the user. Accounts that hold traditional currency are subject to national laws that allow them to be garnished or frozen completely, while cryptocurrency exists outside the regulations and laws that allow this to happen. Using credit cards or bank accounts for international transactions lead to delays.

Being linked to the legal tender of a specific government can render attempted payments subject to exchange rates, fluctuating interest rates, and country-to-country transaction fees, which can slow the process. Users worldwide can download the free, open-source software with which they can transfer funds securely, anonymously and virtually instantaneously across vast distances.

While it does not have any views regarding the effectiveness, soundness, integrity or robustness of virtual currencies as a payment system, the SARB contends that there is no significant risk to financial stability, price stability or the National Payment System South African Reserve Bank Position Paper on Virtual Currencies December at However, while the SARB sees no significant risk in cryptocurrency, it has cautioned end-users, whether individuals or businesses, that any activities performed or undertaken with such currencies are at their sole and independent risk.

Is virtual currency here to stay? Bitcoin, however, falls outside of the definition of legal tender. Merchants are also not legally obliged to accept Bitcoin as legal payment, whereas they may not refuse legal tender.

Additionally, virtual currencies are not defined as securities in terms of the Financial Markets Act 19 of They are, therefore, not subject to the regulatory standards that apply to the trading of securities. Bitcoin operates without the authority or administration of any state or banking institutions.

This leads to various issues, including concerns about —. Cryptocurrencies are not illegal per se. They are regularly utilised by consumers to conclude all manner of legitimate transactions. Clearly, cryptocurrencies can be harnessed by criminals to further their illegal aims and provide a platform for, inter alia , money laundering and the financing of terrorism South African Reserve Bank Position Paper on Virtual Currencies op cit at 5. In the early days of cybercrime, only extremely knowledgeable and skilled criminals could effectively harness the Internet for nefarious purposes.

With modern criminals becoming increasingly technically proficient and with systems becoming simplified, cryptocurrency is being embraced by a far wider demographic within the criminal classes. Cryptocurrencies are prevalent in almost every country in the world. They offer a potential benefit by increasing access to simplified and efficient payment methods, but they also create potential risk for nations and individuals, as they may be harnessed by criminals to enhance their capacity to carry out money laundering, terrorist financing and other cybercrimes.

It is accepted that criminals are inclined to exploit services with weak or nonexistent anti-money laundering and customer identification programs. The true danger of cryptocurrency is that it is not a traditionally-valued or backed currency; it has the value ascribed to it by its users. It is instantaneous, virtually untraceable, and can allow individuals, groups, companies or even entire countries to exit traditional value-based markets.

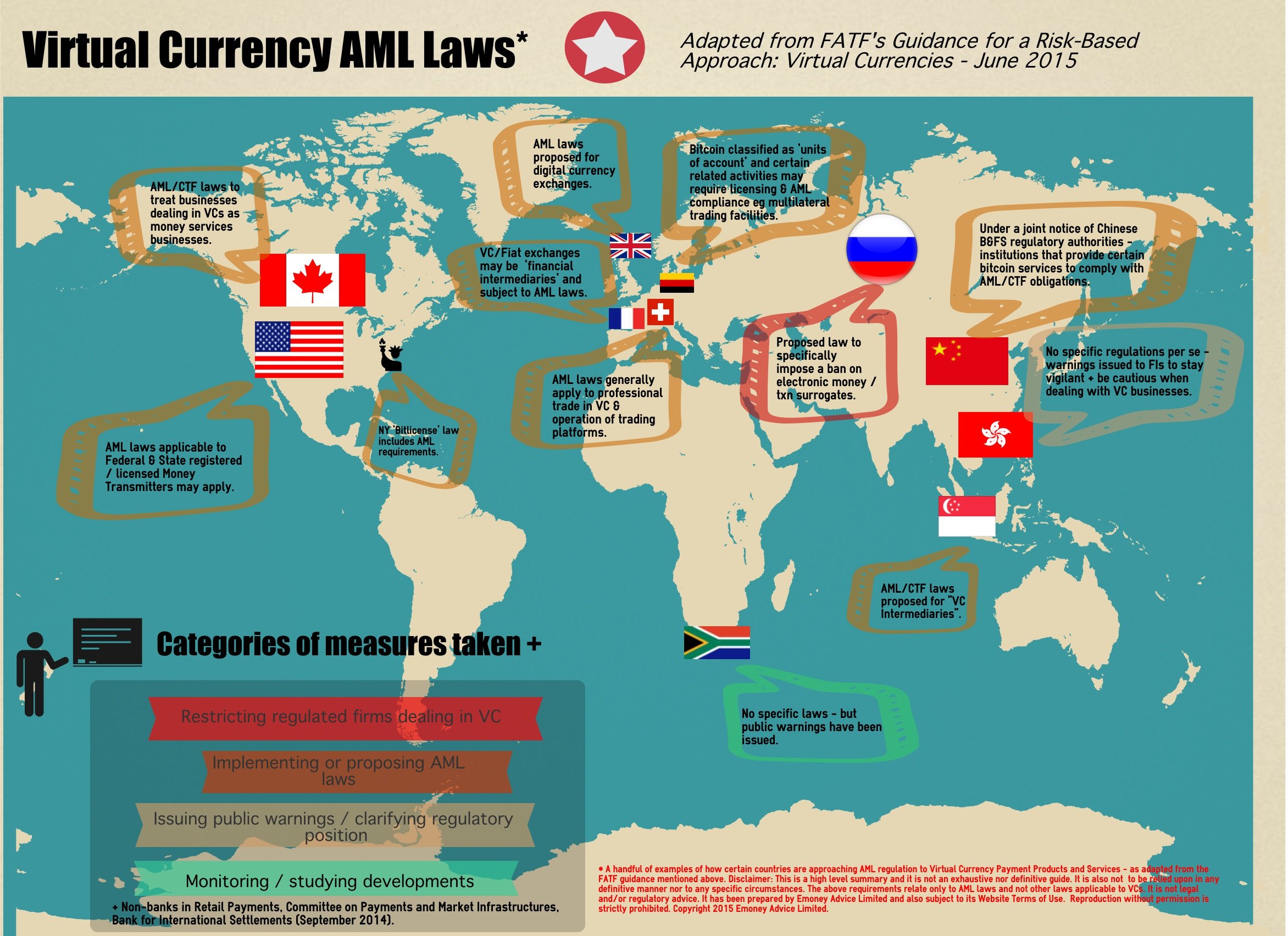

Taken to its worst case scenario, global superpowers could fund terror via a cryptocurrency without there being a possibility of any sanctions. While many jurisdictions are still struggling with implementing appropriate anti-money laundering, know-your-customer and customer due diligence programs Acting Assistant Attorney General Mythili Raman Testifies Before the Senate Committee on Homeland Security and Governmental Affairs www.

The use of cryptocurrency clearly presents law enforcement with various unique challenges but these difficulties are by no means insurmountable. It is apparent that the developments in the sphere of cryptocurrency will require a more coordinated and internationally integrated regulatory framework in future. The challenge for each jurisdiction, as well as global organisations, is maintaining a balance between the introduction of comprehensive, adaptable and robust regulatory systems criminal, financial, legal and protocols, while enabling and supporting technological innovation and growth.

Register Login Contact About. The rise of Bitcoin and other cryptocurrencies December 1st, Views Editorial Opinions Give us your feedback.