Reddcoin faucet rotator

25 comments

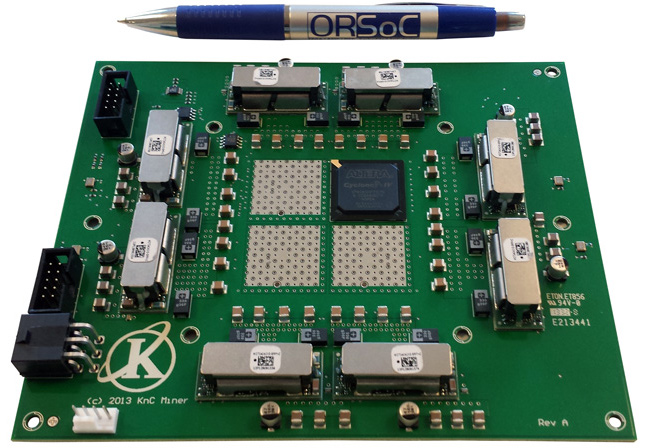

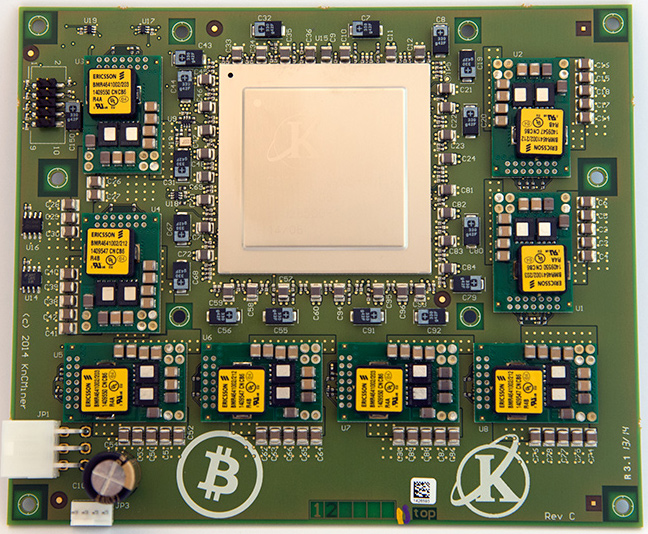

Bitcoin asic miner 100ghs

Some interesting implications came to mind in regards to the hardware, race to zero, competition that has been prominent in the crypto currency community.

Below is an excerpt from an article that I read describing some of the benefits of immersion cooling that lead into the discussion of Moore's Law and the invisible hand that it maintains in the shaping of crypto opportunity.

My interest in this was the chart that displays the technology that has been involved in the mining of BTC and the increase in difficulty that has paralleled hardware competition. My thoughts on this immediately went to observed community post-competition hash rates and the effect that this has on market pricing through its reflection on investment. However we will get to that and in truth we won't.

What I mean by this is that I could crystal ball gaze till the cows come home and we still wouldn't be sure of much.

However my thoughts here tend towards the investment that miners have made and how that can be translated as sign of consumer confidence in the face of such difficulty that produces even further confidence in the unit being mined as entailed below Moore's Law states that the number of transistors on an integrated circuit will double every two years.

In a paper studying the progress of chips used in bitcoin mining, Bedford Taylor concludes that technological advancement in the area has been "amazingly fast" in the face of increasing difficulty. One question is whether this model can scale to other application areas and usher in a new era of bespoke silicon," he wrote. The dark silicon problem says that, as transistor counts on chips increase, the portion of the chip that is actually utilised, given the the chip's power constraints, drops exponentially.

In discussion with other colleagues and friends in the market there is always the actor of consumer confidence that comes up in the conversation of where crypto currency gets its value, how stable that value is, and what will delimit it's growth. What might be seen in the aforementioned hardware race is investment in procuring BTC and thus increasing the price of that of which is being mined.

One question that I might pose, in regards to the feedback loop that is the proposed investment to valuation theory, what will be the other delimiter to its growth. Infinite growth is not achievable and that principle will certainly apply here but how I hope the read yielded a reasonable rate of return to your opportunity in the crypto realm of thought. There is so much in play that is not said in this article in regards to the assumptions made.

If you have additions to this feel free to reach out or comment below. Additionally how the community defines the aforementioned commodity value , with the case of BTC, is a discussion for another post.

In fact probably several posts. As a side note we have toyed around with the idea of producer confidence, as a variable alongside consumer confidence, being necessary to better define a formula aimed at accurate valuation of crypto currency due to its unique nature. Or maybe I just need to dust off the old economics book. Either way I'm writing this on the fly so I will continue to toss this out as these ideas develop and let me know if you would like to discuss further.

This pairs with the discussion of hardware producer stock pricing in correlation to the crypto currency value that they support. Good read on infinite growth expectations ; however not totally applicable but still a good read. The first chips were in nm, a relatively old process.