Chanel hot pink clutch

28 comments

Bitcoin miner website

Some months it has been crazy interesting, but most months it has been slow and boring. Fast-forward to the last couple of months, the media has been in a frenzy. Everyone is talking about making a quick buck by investing, and even the smart people who understand the technology often throws around vague statements that blockchain will change the world but never really are able to say more than this.

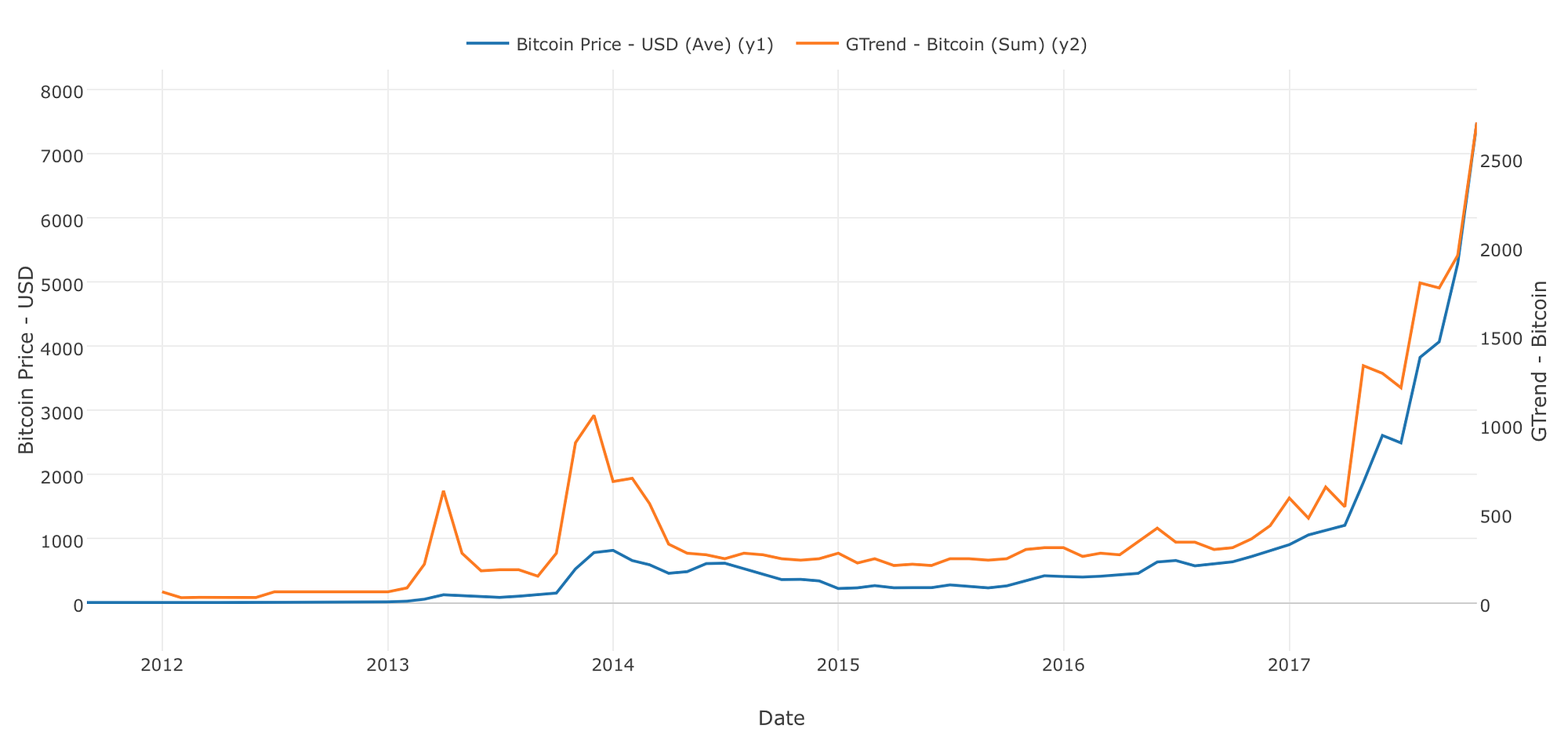

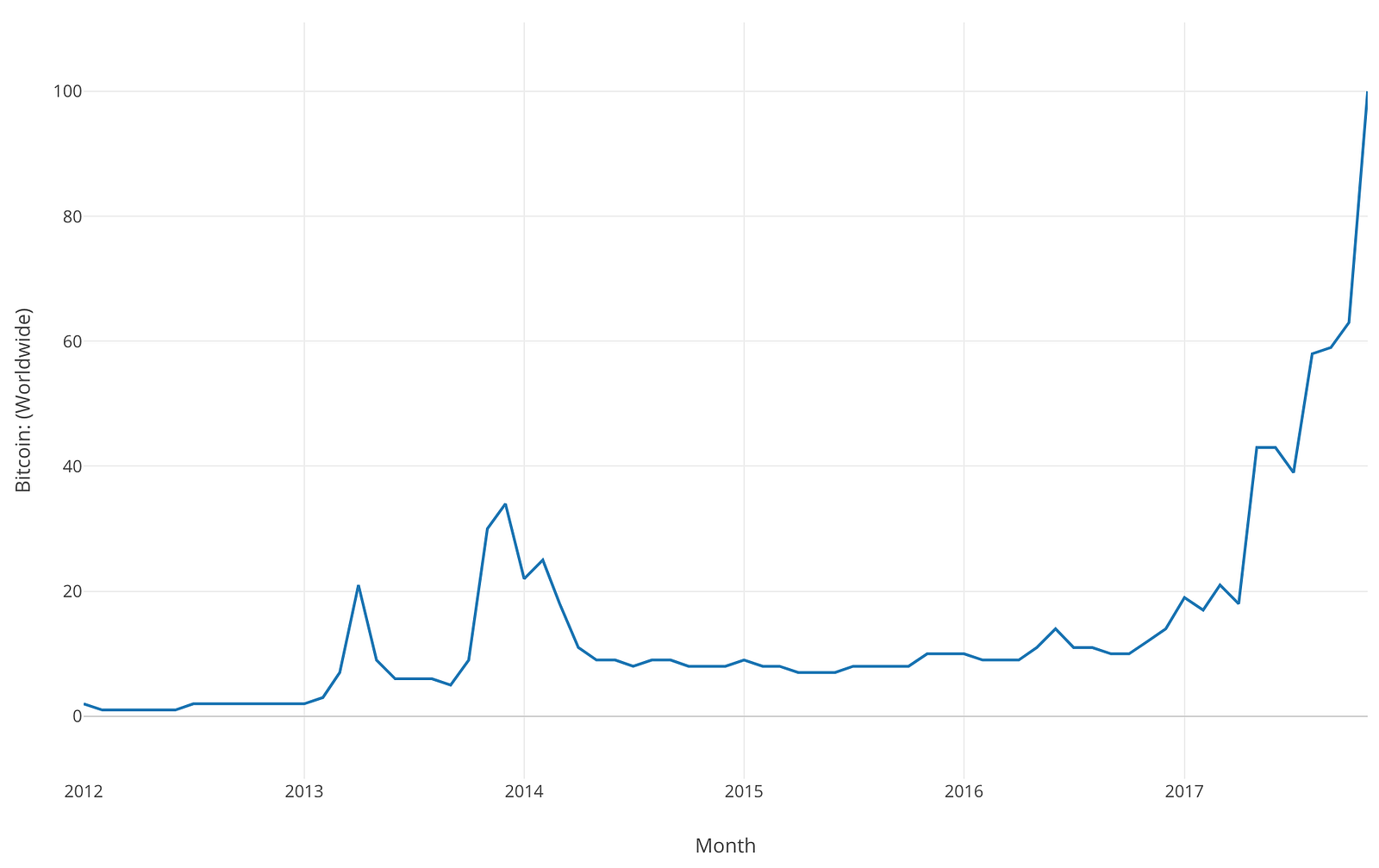

I hope to help those things get right, by making this post. We should focus more on the future:. Back to today , this is Google Trends comparing the search volumes of Bitcoin and Trump — and Bitcoin is more popular in the search engine Google:. I can also feel this myself. This is nothing like , where we had our monthly Bitcoin meetups in shady bars discussing the future of money.

No, this frenzy is everyone talking about Bitcoin, even people who have absolutely no clue about what Bitcoin or the blockchain is. However, the smartest people I know is divided between category 2 and 3.

The challenge with category 2 and 3, is their discussions suck. I am convinced that both category 2 and 3 people are right. But , I also believe that blockchain will fundamentally change the world. With Bitcoin being the first, and by a big magnitude, the biggest cryptocurrency, I also believe we could see price doublings in the hundreds in the future. But why is it the blockchain is so awesome?

Why is it I can say with a straight face that such doublings could happen? In addition, just because the blockchain gets popular, will it also result in Bitcoin growing popular? This post is trying to do many things. We are going to cover exactly what Bitcoin and blockchain are, so you can make up your own mind.

After this post, you will not only know how the technology works , but also why the smartest people are so hyped about blockchain. You will also be able to discuss blockchain with friends and family and be the expert — and most importantly — look behind the complete nonsense that is happening on social media and the news. And in the end, you can make up your own mind: We will introduce the basics.

What is Bitcoin, Blockchain, Bitcoin mining and everything we need to understand to continue. Phase 1 will be the foundation for everything we are going to dicuss in phase 2 and phase 2. We will zoom out, and look at what blockchain really can do. We will see that there is so much more than Bitcoin — and understand decentralization to the core.

We will use all our new knowledge to look and predict the future. If I ask a stranger: How can something be released anonymously? What is a pseudonym? And why does the name sound Japanese? And why do I want a peer-to-peer electronic cash system? Bitcoin is pretty complex. I plan to do the opposite. In academia, new research is published in the form of a white paper. A white paper is basically a pretty short report that is very compact, often very difficult to read and full of formulas.

When researchers and their Ph. The research team then try to get their white paper published at a fancy industry publisher, that publishes the newest research. Then, if successful, the researchers are allowed to present the paper at a conference. White papers are usually written by a group of people; for instance the professor and some students or an internal team at a big corporation.

This could be a Japanese professor. It could be a team in the US. It would be a random dude from anywhere in the world. It could be NASA. It could be me. The reason this white paper became so popular, was because it solved a problem researchers around the world have attempted to solve for a long time.

So during the last couple of decades, various groups and researchers have attempted to create a digital cash system. Why not just trust PayPal? This is a very valid question — and a question we are going to get back to again and again throughout this post. For now, this is not so important — and we will get back to it. PayPal is not a currency, nor would you want it to be. PayPal is more like a smart bank account, but not a currency.

Before this was only possible by governments to make new currencies such as the Dollar or Euro. The problem we have: If I sell you milk, but you have already spent all your money on cookies, I need to know before I give you my milk. This might seem simple, but this problem was never solved.

The reason Bitcoin got so much hype is that the white paper solved this problem. This was an early meme and ad for Bitcoin. Bitcoin in itself is actually super simple it is! Bitcoin is basically a long list of all transactions ever made since Bitcoin was launched.

So if Jane buys milk from Jason and pays with Bitcoin, this is stored in the system. And it will be stored forever. Since every single transaction is stored, and everyone can see them, we always know how many Bitcoin everyone has. The thing they transfer is called Bitcoins.

This is very simplified what Bitcoin is: The way the blockchain work is that when you make a transaction, you store it in a block together with other transactions. This will create 4 transactions because each of you just bought a Mai Tai cocktail.

These 4 transactions are all put together in a block. Every ten minutes, the Bitcoin system will take all transactions made in the last ten minutes. Then this block is attached to what we call the blockchain. When the block is attached, your transaction is stored forever and added to the blockchain. This is a decision made in Bitcoin, and other alternatives have picked a different time than ten minutes. Does it mean I can only do one transaction every ten minutes?

Can I run this on a smartphone? In theory, but you are going to actually use Bitcoin through user-friendly websites and apps. As long as you had a computer and you opened the Bitcoin program, you would essentially be running a payment network like VISA and MasterCard. What does this mean? It means you should be able to send Bitcoins to other users yourself. So when I want to buy a smartphone from you, I pay you some Bitcoin. I do this by making a transaction. The transaction is then stored in a block.

After waiting maximum ten minutes we know the Bitcoin was transferred. But this brings up some questions — so how much is a Bitcoin? How can a Bitcoin be worth anything? The history of money is long, and, actually quite exciting. Looooong time ago, we humans started out with the barter system: I give you some milk, and you give me some tomatoes. This evolved century after century, ultimately leading to the system we know today which involves banks, cash, debt, loans and lots of interesting financial products.

Today, if we have 1 Dollar, we feel it has a certain value. The Dollar has a value because I can go down to the local store, and buy something with it. If I have dollars, I can get food, I can get drunk and I can even buy a plane ticket to travel the world.

If I could not buy something with it, I would not give it any value. It used to be that you could go down to the bank, present your dollar notes, and get the same value of gold. The dollar has a value because we tell each other it is worth something. If we start not to believe in it, it will decrease significantly in value. This is important to realize. In a normal day to day environment, we think our currency is stable.

But if we look at money with more broad eyes, this is actually not always the cash.