Tesla Stock (TSLA)

5 stars based on

57 reviews

Day trading in stocks is an exciting market to get involved in. Stocks are essentially capital raised by a company through the issuing and subscription of shares. While stocks and equities are thought of as long-term investments, they offer exciting opportunities for day traders. The ability to short prices, or trade on company news and events, mean short-term trades can still be profitable. This page will advise you on which stocks to look for when aiming for short-term positions.

It will also offer you some invaluable rules for day trading stocks to follow. Day trading stocks today is dynamic and exhilarating. On top of that, they are easy to buy and sell. With the world of technology, the market is readily accessible.

The liquidity in markets means speculating on prices going up or down in the short term is absolutely viable. Also, stocks are relatively straightforward to understand and follow. Whilst day trading in the complex technical world of cryptocurrencies or forex may leave you scratching your head, you can get to grips with the triumphs and potential pitfalls of Google and Facebook far easier.

Before you start day trading stocks, you should consider whether it definitely suits your circumstances. For example, intraday trading usually requires at least a couple of hours each day. One of those hours will often have to be early in the morning when the market opens. Longer term stock investing, however, normally takes up less time.

This is because you have more flexibility as to when you do your research and analysis. In addition, intraday trading returns can exceed those of long-term investing. This in part is due to leverage.

This allows you to borrow money to capitalise on opportunities trade on margin. However, with increased profit potential also comes a greater risk of losses. On top of that, you will also invest more time into day trading for those returns.

You could also argue short-term trading is harder unless you focus on day trading one stock only. This is because interpreting the stock ticker and spotting gaps over the long term are far easier. However, this also means intraday trading can provide a more exciting environment to work in. There is no easy way to make money in a falling market using traditional methods.

Day traders, however, can trade regardless of whether they think the value will rise or fall. Overall, there is no right answer in terms of day trading vs long-term stocks. Spotting trends and growth stocks in some ways may be more straightforward when long-term investing.

Having said that, intraday trading may bring you greater returns. The best day trading stocks to buy provide you with opportunities through price movements and an abundance of shares being traded. This will enable you to enter and exit those opportunities swiftly.

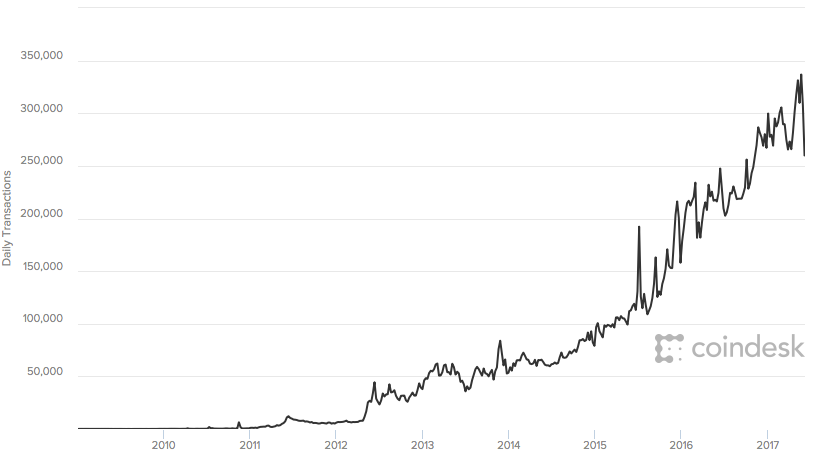

These factors are known as volatility and volume. Volume is concerned simply with the total number of shares traded in a security or market during a specific period.

Each transaction contributes to the total volume. If just twenty transactions were made that day, the volume for that day would be twenty. How is that used by a day trader making his stock picks? Volume acts as an indicator giving weight to a market move. If there is a sudden spike, the strength of that movement is dependant on the volume during that time period. If you have a substantial capital behind you, you need stocks with significant volume. Whilst your brokerage account will likely provide you with a list of the top stocks, one of the best day trading stocks tips is to broaden your search a little wider.

Look for stocks with a spike in volume. If a stock usually trades 2. If your chosen platform fails to offer a rigorous screener for high volume stocks, utilise these alternatives:. If it has a high volatility the value could be spread over a large range of values. This would mean the price of the security could change drastically in a short space of time, making it ideal for the fast-moving day trader. One way to establish the volatility of a particular stock is to use beta.

A stock with a beta value of 1. On the flip side, a stock with a beta of just. How you use these factors will impact your potential profit, and will depend on your strategies for day trading stocks. Now you have an idea of what to look for in a stock and where to find them. Below is a breakdown of some of the most popular day trading stock picks. Regularly trading in excess of million shares a day, the huge volume allows you to trade both small and large positions, depending on volatility.

You could also start day trading Australian stocks, Chinese stocks, Japanese stocks, Canadian stocks, Indian stocks, plus a range of European stocks. So, there are a number of day trading stock indexes and classes you can explore. Furthermore, you can find everything from cheap foreign stocks to expensive picks.

All of the strategies and tips below can be utilised regardless of where you choose to day trade stocks. Timing is everything in the day trading game. With that in mind:. The pennant is often the first thing you see when you open up a pdf of chart patterns. The converging lines bring the pennant shape to life. You should see a breakout movement taking place alongside the large stock shift. You will then see substantial volume when the stock initially starts to move. Finally, the volume in the pennant section will decrease and then the volume at the breakout will spike.

You will normally find the triangle appears during an upward trend and is regarded as a continuation pattern. Less often it is created in response to a reversal at the end of a downward trend. Whenever they do occur, ascending triangles are bullish patterns when the small black candlestick is followed by a big white candlestick that totally engulfs the previous candlestick. Although often a bearish pattern, the descending triangle is a continuation of a downtrend.

Less frequently it can be observed as a reversal during an upward trend. Just a quick glance at the chart and you can gauge how this pattern got its name. Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. Straightforward to spot, the shape comes to life as both trendlines converge. They come together at the peaks and troughs.

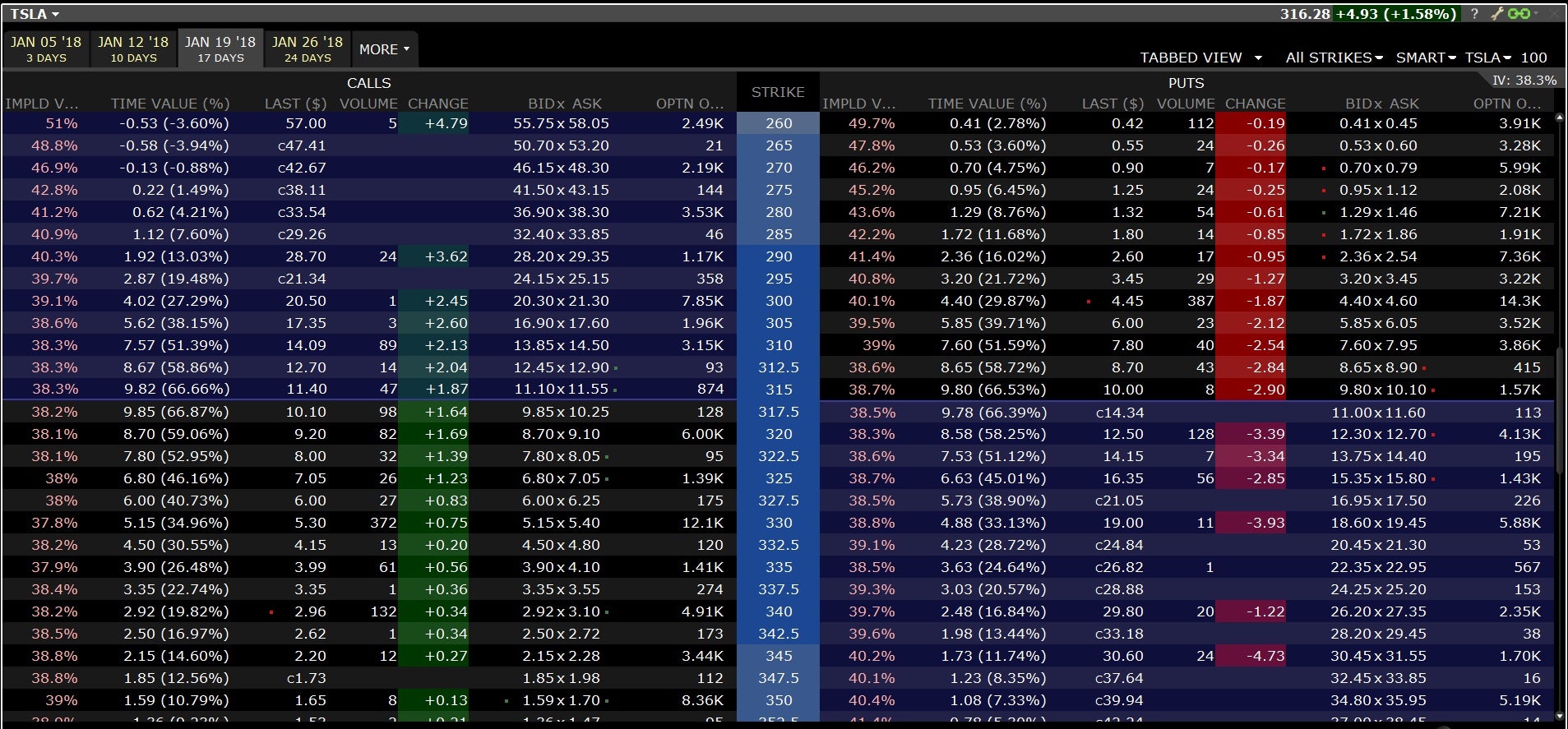

The lines create a clear barrier. If the price breaks through you know to anticipate a sudden price movement. Rather than using everyone you find, get excellent at a few. The patterns above and strategies below can be applied to everything from small and microcap stocks to Microsoft and Tesla stocks.

If you like candlestick trading strategies you should like this twist. A candlestick chart tells you four numbers, open, close, high and low. But you use information from the previous candles to create your Heikin-Ashi chart. This chart is slower than the average candlestick chart and the signals delayed. This is part of its popularity as it comes in handy when volatile price action strikes. The strategy also employs the use of momentum indicators.

A simple stochastic oscillator with settings 14,7,3 should do the trick. If you see that two candles, either bearish or bullish have fully completed on your daily chart, then you know the pattern is valid. These charts, patterns and strategies may all prove useful when buying and selling traditional stocks.

However, they may also come in handy if you are interested in the less well-known form of stock trading discussed below. Every day thousands of people turn on their computers in the hope of day trading penny stocks online for a living. But what exactly are they? To help you decide whether day trading on penny stocks is for you, consider the benefits and drawbacks listed below.

Unfortunately, many of the day trading penny stocks advertising videos fail to point out a number of potential pitfalls:. Perhaps then, focussing on traditional stocks would be a more prudent investment decision. However, there are some individuals out there generating profits from penny stocks. So, if you do want to join this minority club, you will need to make sure you know what a good penny stock looks like. On top of that, when it comes to penny stocks for dummies, knowing where to look can also give you a head start.

For example, the metals and mining sectors are well-known for the high numbers of companies trading in pennies. Overall, penny stocks are possibly not suitable for active day traders. However, if you are keen to explore further, there are a number of day trading penny stocks books and training videos available. From above you should now have a plan of when you will trade and what you will trade.