Bitcoin charts mtgox audrands

46 comments

Line follower code nxt robot using atmega32

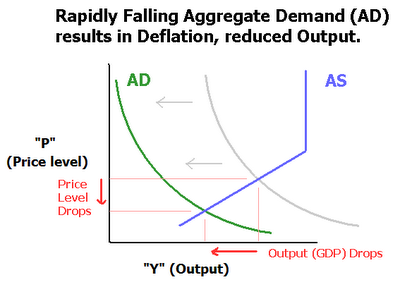

Deflationary spiral is an economic argument that proposes that runaway deflation can eventually lead to the collapse of the currency given certain conditions and. Amazon has large economies of scale in its operations warehouses and delivery. Bitcoin, the Supernova of Deflation In this way, your participation is required to transfer your sum to a new owner, with security of the system maintained by the difficulty of anyone simply guessing the code.

The enthusiast hard core is willing to bear conversion costs and FX risk mainly because they are bitcoin investors, and they believe capital gains on bitcoin will usually compensate. People in high-inflation countries with sufficient Internet access are increasingly seeking refuge in bitcoin. Typically the term is used for the whole economy but the same mechanism might apply to the bitcoin market: So once the fad fades, well, the equilibrium price of bitcoin is zero.

And, unlike cash, the bitcoin block chain contains a complete record of every bitcoin transaction from the genesis block. A second problem with bitcoin relates to the supposed low transaction fees. Pros and cons of a mature Bitcoin economy - New Atlas. Deflationary spirals are not something anyone holding onto bitcoin ever need fear. If you only know the string that came out as a result of the operations, about the only way you can guess what went in is by trying every possible input string, a very time-consuming process even for the fastest computers.

It all depends on the incentives provided to the bitcoin miners, whose role is to verify transactions. The total supply of bitcoins is expected to grow geometrically until it reaches a finite limit of 21 million. I do not know what to call this, but it is conceptually separable. A solution is another string such that when the solution string and challenge string are put through a crypto hash function, a certain number of the leading elements of the resulting string are zeros.

BitCoin is designed to work like the Gold Standard in that it is a fixed pool of currency. All About Bitcoin Mining: Road To Riches Or Fool. But, this process results in a probability distribution that governs the chance that any particular miner will solve the problem. The libertarian background to the deflationary design of How does the system prevent someone from counterfeiting bitcoins. I guess any medium of exchange beyond straight barter requires some leap of faith.

Is bitcoin deflation a bad. One rule of the bitcoin protocol is that the block chain the system will accept is the one that has the most proof of work associated with it cumulatively from the genesis block. Deflationary collapse or Deflationary spiral. For an ordinary person with dollar income to pay with bitcoin, there are five cost factors.

It is an interesting study in deflation that one Bitcoin could buy one blazer in April of Oleg Andreev - Deflationary Spiral Each bitcoin miner must solve a proof of work problem to verify a block. Think of the BitCoins as something like gold - gold is also a finite resource and gets incrementally more difficult to mine, yet no deflationary spiral has set in.

As a result, Bitcoin is considerably easier for law enforcement to trace than cash, gold or diamonds. The deflationary spiral has definit. Would all new currencies be deflationary. At the moment, there are more than a few protocols, but bitcoin has a huge head start, and as things move forward it will most likely become entrenched to the point that no alternative is necessary or desired.

So, if you follow that process, the money supply process will stop in a little over years from now with a maximum number of bitcoins of 21 million. The Case of Bitcoin. Perhaps it is safer to keep money in this digital form rather than risk theft of cash. How does the system prevent someone from double spending bitcoins.

It is a dying web site from which you can no longer get bitcoins nor dollars. In the end they too failed to hold their value as a trendy collectible with exchange markets eBay. This makes Bitcoin a poor long-term candidate for a stable, alternative medium of exchange. Every time a Bitcoin is mined it becomes harder to discover the next one.

In other words, there will be a deflationary spiral in the Bitcoin economy. Those future transaction fees will be on top of the four cost factors I mentioned. Perhaps the miniscule transaction time it takes to acquire ordinary money going to the bank or ATM might be lessened. Skip to content Deflationary spiral is an economic argument that proposes that runaway deflation can eventually lead to the collapse of the currency given certain conditions and.

Pros and cons of a mature Bitcoin economy - New Atlas Deflationary spirals are not something anyone holding onto bitcoin ever need fear. The Case of Bitcoin Perhaps it is safer to keep money in this digital form rather than risk theft of cash.