Selles abondantes et liquides ioniques

27 comments

Crypto bitcoin exchange

Day trading cryptocurrency has boomed in recent months. High volatility and trading volume in cryptocurrencies suit day trading very well. Here we provide some trading tips for day trading cryptocurrency, including information on strategy, software and trading bots — as well as specific things new traders need to know, such as taxes or rules in certain markets.

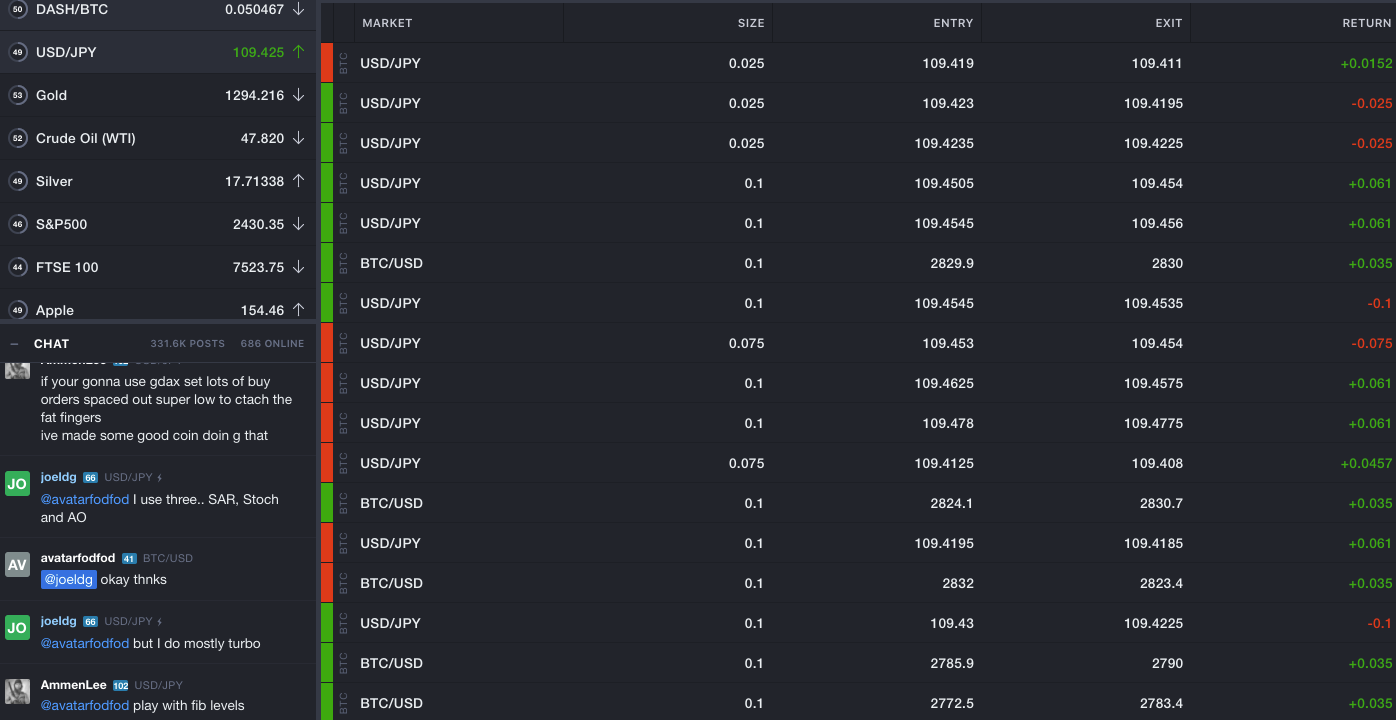

Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. The cryptocurrency trading platform you sign up for will be where you spend a considerable amount of time each day, so look for one that suits your trading style and needs. Always check reviews to make sure the cryptocurrency exchange is secure.

So whilst secure and complex credentials are half the battle, the other half will be fought by the trading software. Each exchange offers different commission rates and fee structures. As a day trader making a high volume of trades, just a marginal difference in rates can seriously cut into profits. There are three main fees to compare:. Do the maths, read reviews and trial the exchange and software first.

Coinbase is widely regarded as one of the most trusted exchanges, but trading cryptocurrency on Bittrex is also a sensible choice. IO, Coinmama, Kraken and Bitstamp are other popular options. Before you choose a broker and trial different platforms, there are a few straightforward things to get your head around first.

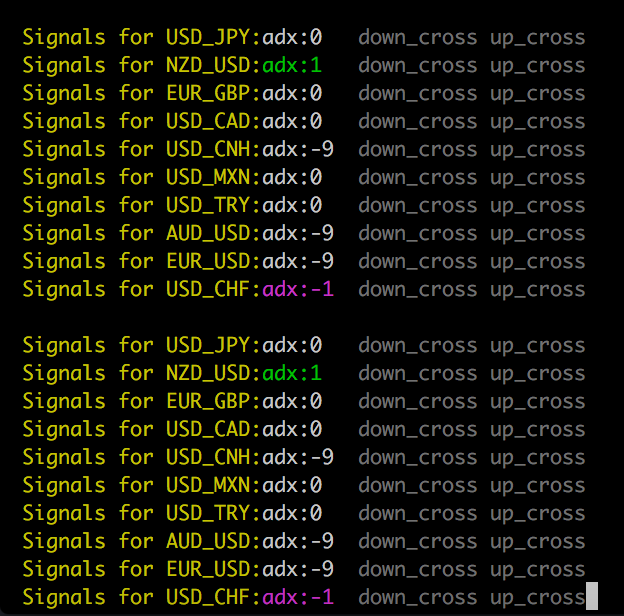

Understanding and accepting these three things will give you the best chance of succeeding when you step into the trading arena. Below is an example of a straightforward cryptocurrency strategy. This straightforward strategy simply requires vigilance. A correction is simply when candles or price bars overlap. You should see lots of overlap. This tells you there is a substantial chance the price is going to continue into the trend.

You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high. Even with the right broker, software, capital and strategy, there are a number of general tips that can help increase your profit margin and minimise losses.

Below are some useful cryptocurrency tips to bear in mind. Short-term cryptocurrencies are extremely sensitive to relevant news. When news such as government regulations or the hacking of a cryptocurrency exchange comes through, prices tend to plummet. Analyse historical price charts to identify telling patterns. History has a habit of repeating itself, so if you can hone in on a pattern you may be able to predict future price movements, giving you the edge you need to turn an intraday profit.

For more details on identifying and using patterns, see here. This is one of the most important cryptocurrency tips. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. The more accurate your predictions, the greater your chances for profit. If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential profit if your prediction materialises.

Exchanges have different margin requirements and offer varying rates, so doing your homework first is advisable. Bitfinex and Huobi are two of the more popular margin platforms. The digital market is relatively new, so countries and governments are scrambling to bring in cryptocurrency taxes and rules to regulate these new currencies. Many governments are unsure of what to class cryptocurrencies as, currency or property. S in introduced cryptocurrency trading rules that mean digital currencies will fall under the umbrella of property.

Traders will then be classed as investors and will have to conform to complex reporting requirements. Details of which can be found by heading to the IRS notice On top of the possibility of complicated reporting procedures, new regulations can also impact your tax obligations.

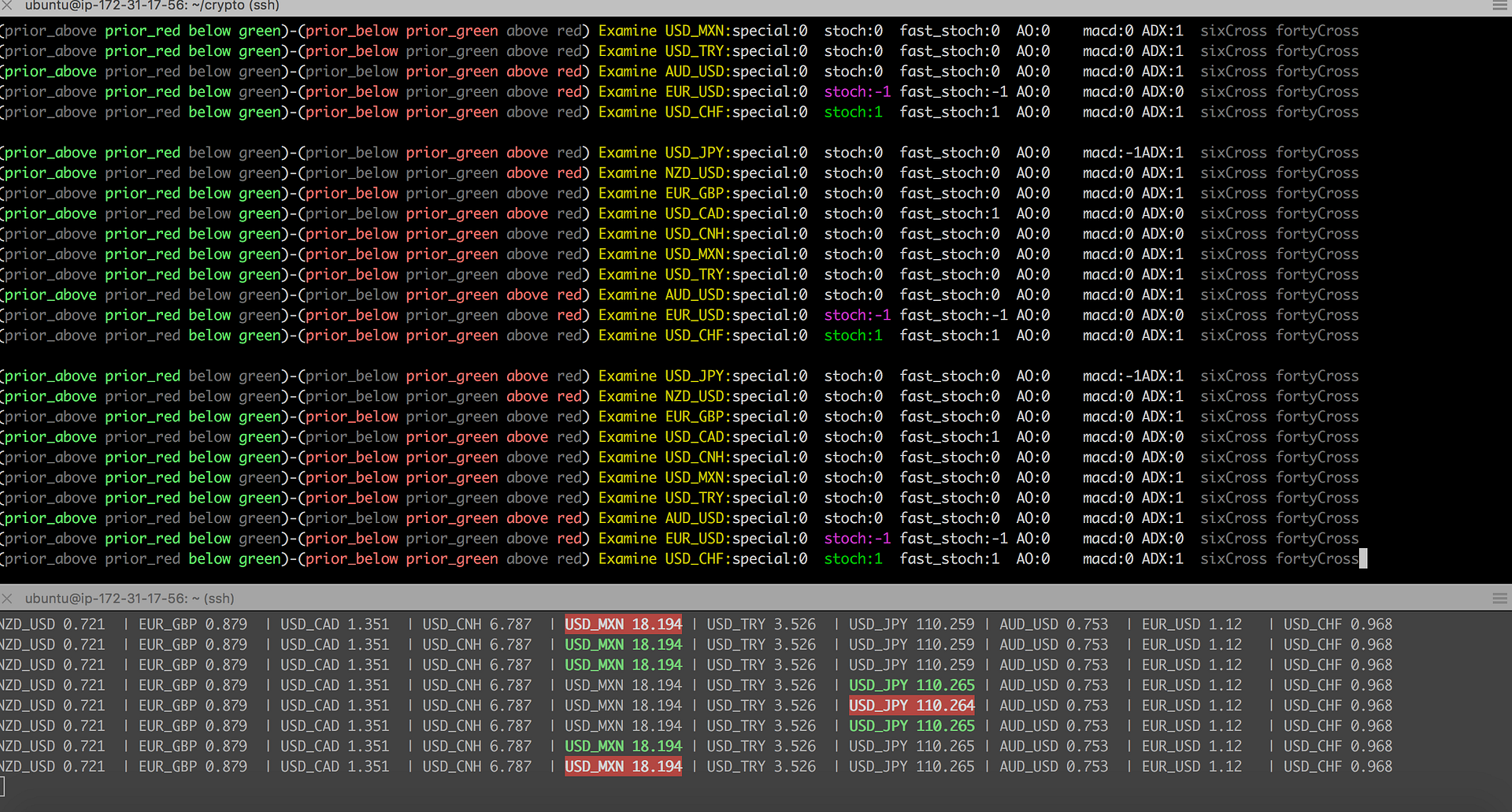

Each countries cryptocurrency tax requirements are different, and many will change as they adapt to the evolving market. There are two benefits to this. Firstly, it will save you serious time. Trade execution speeds should also be enhanced as no manual inputting will be needed. Secondly, automated software allows you to trade across multiple currencies and assets at a time.

That means greater potential profit and all without you having to do any heavy lifting. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent.

They can also be expensive. Whilst there are many options like BTC Robot that offer free 60 day trials, you will usually be charged a monthly subscription fee that will eat into your profit. They can also be expensive to set up if you have to pay someone to programme your bot. So, whilst bots can help increase your end of day cryptocurrency profit, there are no free rides in life and you need to be aware of the risks. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated.

The most useful cryptocurrency trading tutorial you can go on is the one you can give yourself, with a demo account. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. Secondly, they are the perfect place to correct mistakes and develop your craft. Online you can also find a range of cryptocurrency intraday trading courses, plus an array of books and ebooks. When choosing your broker and platform, consider ease of use, security and their fee structure.

There are a number of strategies you can use for trading cryptocurrency in Whichever one you opt for, make sure technical analysis and the news play important roles. Brokers Reviews 24Option Avatrade Binary. Reviews 24Option Avatrade Binary. Crypto Brokers in Germany. Trade Forex on 0. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets.

Established spread betting, forex and CFD broker with over 30 years in the business. Regulated around the globe. Leverage and spreads improve with each account level - Bronze, Silver or Gold. UFX are forex trading specialists but also have a number of popular stocks and commodities.

Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. Based in Australia, HighLow offer a superior binary options experience. Regulated by ASIC, the firm run an honest and transparent service with a great platform. Avatrade are particularly strong in integration, including MT4.

Zulutrade provide multiple automation and copy trading options across forex, indices, stocks and commodities markets. Deposit and trade with a Bitcoin funded account! New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies.