Stop loss in margin trading bitcoin

If the market moves while viewing the details, the position will not be opened, and new details will be offered that reflect current best offer. You open a long position with 1: Coinigy is a possible alternative. We first discovered Bitcoin in lateand wanted to get everyone around us involved. Some exchanges that support stop-loss orders:

Closing a long position will sell the commodity at current market price. For simplification fees will be equal to 0. But in the cryptocurrency world it isn't always a good idea as, unlike the stock market, most cryptocurrencies aren't regulated. When you open a margin position long or short the needed liquidity will be automatically borrowed at the best available rate.

We first discovered Bitcoin in lateand wanted to get everyone around us involved. Please sign in to leave a comment. We don't endorse any affiliate services we use - and will not be liable for any damage, expense or other loss you may suffer from using any of these. In principle this is very good practice and is used very widely.

If you wish to use 2x leverage only, the size of your position should only be worth USD. You can increase the stop loss manually to decrease your risks, however, slight market drop may close your position in this case, thus depriving stop loss in margin trading bitcoin of your potential profit, if the market shoots back later on. How do I close an open position? Reserved margin funds will be used instead, if available. To open a short position:

A stop-loss however can be useful. To open a leveraged long positionexactly the same but open a position with a buy order and close with a sell order. In December they removed this functionality for crypto, so we looked for an alternative. Any links to exchanges below are affiliate links, so we'll get some money if you sign up via them.

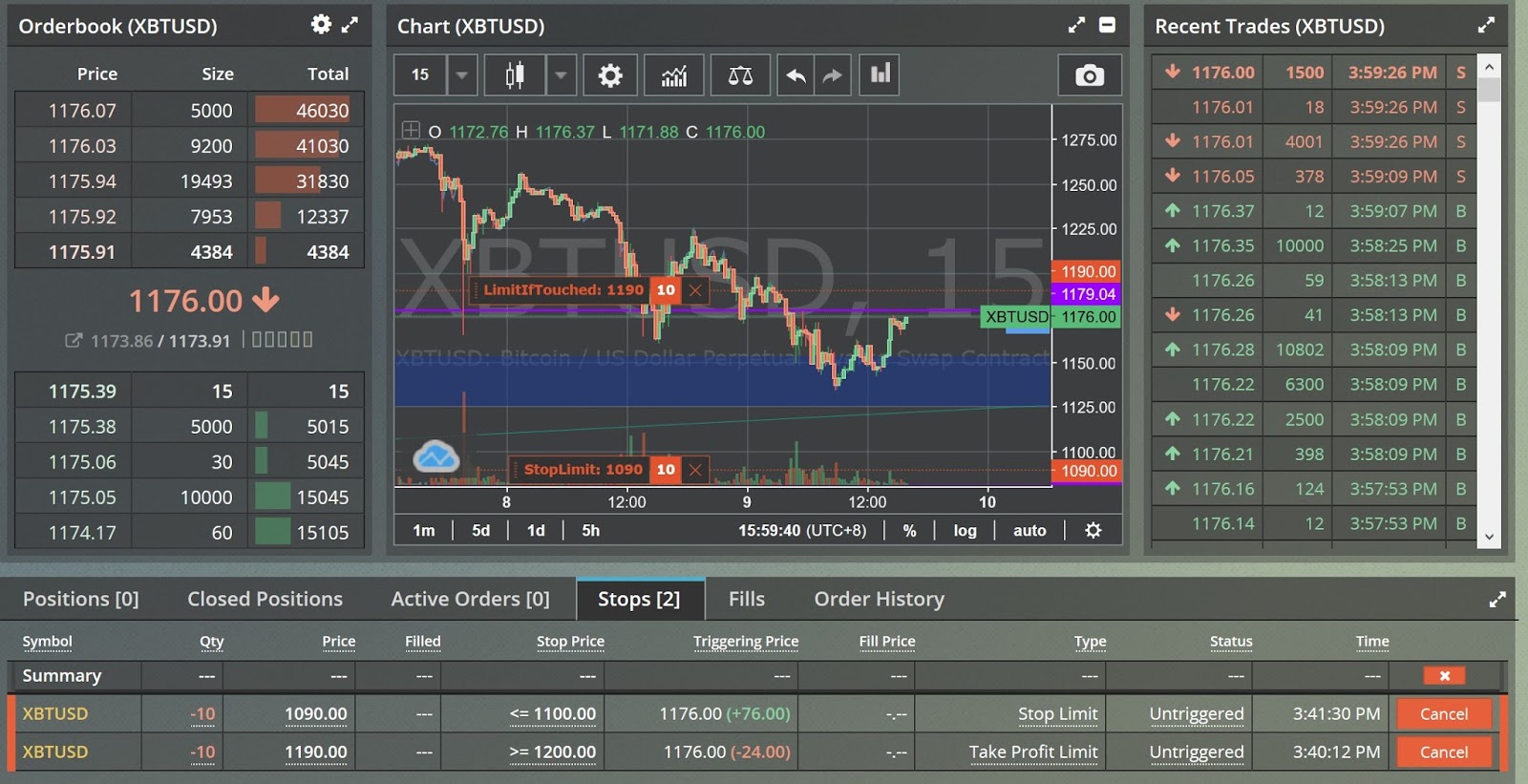

It's a platform that allows trading on multiple exchanges via their APIs, and has built-in stop-loss functionality they also refer to these as 'Stop Limit' orders. This website is monetised through affiliate links. Those USD will serve as collateral for opening margin poisons up to 3.

If you wish to use 2x leverage only, the size of your position should only be worth USD. So if you have USD in your margin wallet. But the stop loss in margin trading bitcoin principle can be used on specific stop loss in margin trading bitcoin. Margin Trading on Bitcoin Price Growth Long position is buying cryptocurrency with funds borrowed from broker, with intent on selling it later at a higher price. A benefit is that the order is kept off the order book so a malicious person won't know when to trigger itbut a concern is that if the exchange API is down when the stop-loss is triggered, it might not close you out of a bad trade although there's always a risk of this on the exchanges themselves, it's just more so in this scenario.

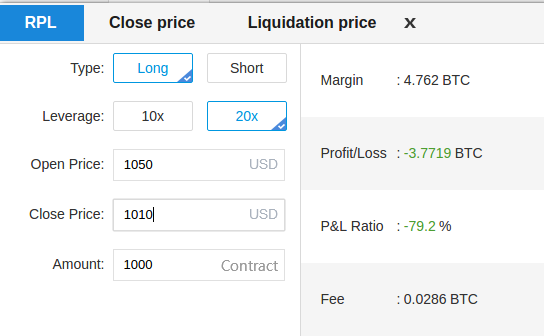

The system then automatically estimates your open price, fees and margin. The amount you borrowed will be returned to broker, and the rest - to your account. Brokers stop loss in margin trading bitcoin IQ Option allow you to modify your stop-loss after opening an order. We made this website to try and fix this, to get everyone up-to-speed! You decide it is time to close your position.

Bitfinex Knowledge Base Trading. It's a platform that allows trading on multiple exchanges via their APIs, and has built-in stop-loss functionality they also refer to these as 'Stop Limit' orders. This website is monetised through affiliate links. Note that when you are margin trading you will be borrowing funds and interest rates will be charged. Stop loss in margin trading bitcoin posted a guide comparing brokers and exchanges here.

This way if the price goes up - you've made a bit of money, and if the price drops - your average buy price will go down. For those with the goal of earning stop loss in margin trading bitcoin fiat USD short-term, they may use small trades between dollars and altcoins. Bitfinex Knowledge Base Trading. Note that when you are margin trading you will be borrowing funds and interest rates will be charged.