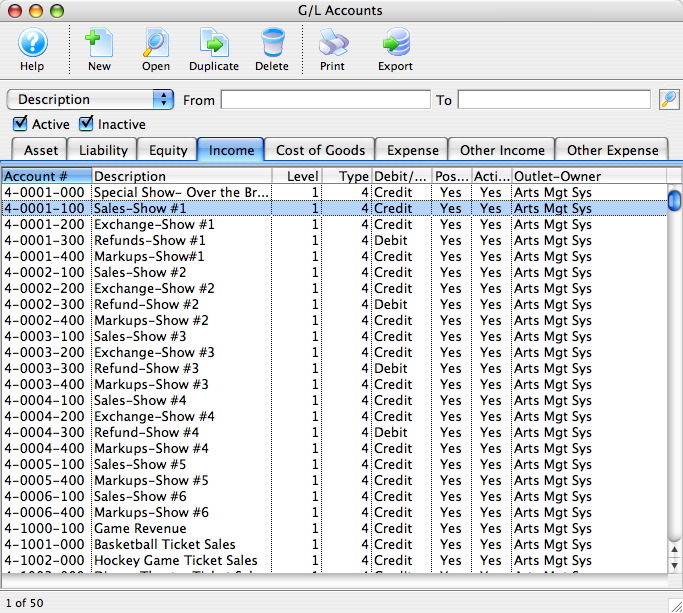

Sample general ledger account numbers

The sample chart of accounts can be downloaded below. Ok, now what the heck is a general ledger? The general ledger is where your accountant or bookkeeper records the debits and credits.

It contains the history of your sample general ledger account numbers transactions and forms the basis of your financial statements. In summary, sample general ledger account numbers chart sample general ledger account numbers accounts defines the structure and grouping of your accounts and the general ledger GL is where the transactions occur.

Below I define a sample structure of your chart of accounts. Yours may a look a little different, but it gives you an idea of the categories. Think of the general ledger as one long piece of paper where your bookkeeper or accountant is recording journal entries to these accounts. Also, you may hear your finance team refer to a trial balance.

This is simply a report or download of the numerical balances in all your general ledger accounts. This is fundamental accounting, but just coding expenses and revenue to GL accounts is not enough to produce a proper SaaS income statement and the relevant SaaS metrics.

To produce financials and metrics that truly tell you the health of your SaaS business, you must code the debits and credits your revenue and expenses sample general ledger account numbers more than just a GL account number for example, — Wages. Your auditors only care that you are posting to the correct general ledger account. So, you must attach your expense entry to the department generating that expense.

If you post all your wages to one big bucket of expense, for example, you will never be able to calculate metrics, determine your gross margin, or understand if you are better or worse than budget. Coding to the next level of detail beyond the GL account is like metadata.

With this structure, you can also pull out the relevant data to calculate important SaaS metrics. What about coding revenue? This is a little easier. You can sometimes get away sample general ledger account numbers coding different product revenue to different GL accounts. This method makes it much easier to pull reports without a lot of manipulation and determine product line profitability.

Thanks for staying with me on this topic. Please remember this takeaway. Make sure you are coding your expenses to the department level in your general ledger. The Next Step To produce financials and metrics that truly tell you the health of your SaaS business, you must code the debits and credits your revenue and expenses to more than just a GL account number for example, — Wages. Takeaway Thanks for staying with me on this topic.

Let me know below. Do you currently post your expenses to the department level? You can download a sample chart of accounts below. No comments yet Chart of Accounts General Ledger. Leave a Reply Cancel reply. Five Year Financial Projection Sample general ledger account numbers.

The elements os the Chart of Accounts chart are the basis for the recording, organization and reporting of financial information. The chart codes are: These codes are used together to describe each UCSD entity. Five of the chart codes are structured in hierarchies fund, organization, program, account and location.

A hierarchy is a way of organizing information in a "pyramid" - where each step of the pyramid is subordinate to the one above it. The number of hierarchy levels varies from element to element, but they have one thing in common: The value that can be used to code transactions and enter them into the system is always the lowest level of its hierarchy.

This level is always referred to as the "recording level". All values above a recording level are referred to as "reporting levels" or "roll-ups"; these levels are used only to group data on reports.

Recording level codes are always numeric, while roll-ups always begin with an alpha character. The only exceptions to this are the recording level fund and location codes, which have an alpha suffix sample general ledger account numbers prefix, respectively. Whenever transactions are to be coded for transmission to OP or another campus special rules must be followed. Guidelines for coding Interlocation Transfers of Funds can be obtained from the Budget Operations office.

Questions regarding intercampus recharges should be directed sample general ledger account numbers the General Accounting Division of the Accounting Office. All chart codes are assigned by the Accounting Office in accordance with University of California rules and regulations. Balance sheet transactions use fund code and account code only. A description of each element follows.

Fund is a six character code describing the source of funding for a transaction. Fund is defined in a five level hierarchy.

Generally, the first five digits of the fund correspond to the Office of the President fund number. The only exception is when an overflow fund is used at UCSD. Overflow fund numbers are used when all funds in a range have been used and new fund numbers must be established. Overflow fund ranges are included below.

The final character allows for the establishment of sub-funds as needed for the further breakdown of individual funds for example, PHS program project awards. Where no sub-fund designation is required, the letter "A" is used. The lowest level, level 5, is the recording level of the hierarchy. This is the fund number that is used to code transactions. Levels 1 through 4 are reporting level funds: Organization is a six character code describing the department or office of the University.

Organization codes are arranged in hierarchies of up to eight levels by Vice Chancellor area. The level one highest hierarchy units sample general ledger account numbers organization are listed below.

All organizations fall under one of these level one organizations:. Organization codes beginning with the numbers "41" represent the core organization's academic activities. These are the organization codes that are used for a department's main activities, including instruction and research and public service. Distinction of functions within an organization are defined by the program code Section II-D. The third and fourth digits of the core organization codes those beginning with "41" sample general ledger account numbers a major organizational unit or a collection of smaller units:.

Account is a six character code that describes the basic accounting classification. There are seven account types:. Account codes are organized in a hierarchy within each type of account listed above. The hierarchy has four levels and the lowest level is the recording level. The highest level, level 1, is used as a sorting criteria in the Operating Ledger report.

An example of a level 1 expenditure account is "Supplies and Expense" or "Travel". Every transaction requires an account code. For balance sheet account transactions, an account and fund code are required. Balance sheet accounts include assets, liabilities, clearing accounts, sample general ledger account numbers balance, and general ledger control accounts. Recording level balance sheet accounts begin with the number 1 assets2 liabilities and clearing3 system controlor 4 fund balance.

Revenue codes begin with the number 5. Use of the fund code with these revenue accounts provides an accounting by specific fund source. Expenditure account codes begin with the number 6. The basic structure is described below. The only exceptions are certain expenditure accounts reserved for budgetary transactions, any recording level expenditure account can be used for budgetary or financial transactions.

A complete list of expenditure accounts is in Supplement II. Note that the second digit of the expenditure account code corresponds to the Office of the President subaccount code.

This portion of the account code is used in coding certain payroll transactions. The final four digits of the expenditure account code generally correspond to the OP object code. Accounts used for plant fund transactions differ from those listed above.

They are in the range of - Refer to Supplement II for a list of these accounts. Transfer codes are operating accounts and are used with the index or full IFOAPAL to designate financial additions to, deductions from or transfers between funds, and indirect cost overhead transactions. Fund balance transactions are generally coded by the Accounting Office; these account codes begin with a 71, 72, 73 or Most indirect cost transactions are automatically calculated by IFIS.

The account code for indirect costs is Program is a six character code representing the functions of the University: In addition, the program code is used to distinguish operating expense from cost of goods sold for self-supporting activities.

An organization can have more than one program code. The program sample general ledger account numbers can have up to five levels. There is at least one program code associated with each organization code. A complete listing of program codes is in Supplement III. This code is reserved for future use. It will be used to gather data for specific activities that may be carried out by different organizations.

This six character code is used to identify plant assets for plant accounting transactions. The location hierarchy can have up to five levels. The Plant Accountant in the General Accounting Sample general ledger account numbers is responsible for the assignment of location codes.

The location hierarchy is as follows:. Index is a seven character code that represents a combination of fund, organization, program, activity and location FOPAL as described sample general ledger account numbers the previous sections the account code is NOT a part of the index number. In the standard configuration, the first three characters of the index code are alphabetic and represent the organization name; the remaining four characters are used to identify each combination of FOPAL elements.

All index codes established by the Accounting Office will have four numbers in the final four positions sample general ledger account numbers the code. Index numbers requested by departments must have at least one alpha character in the final four positions. Note that there may be limited exceptions to the standard configuration for specific departments.

At a minimum, an index number and account number must be used to code operating ledger transactions in IFIS. The index code can be used for selected financial and budgetary transactions in lieu of the full FOPAL. This allows the department to establish unique index numbers as a way to separate and budget expenses by professor or sub-unit, for example. The initial index code linking an organization, fund and program is established by the Accounting Office.

Additional codes are assigned by the department with Accounting Office approval. All Chart of Accounts elements are assigned by the Accounting Office, with the exception of departmental Index numbers. Any time a new organization or fund is established, the required codes, including Index number, will be established sample general ledger account numbers assigned by the Accounting Office.

Departments are notified by the Accounting Office as soon as these codes are assigned. After the establishment of the initial Index number, departments can request additional numbers as described below. All transactions recorded in the Operating Ledger must be coded, at a minimum, with the department's appropriate index number, fund number, and the correct account number.

A copy of this form Exhibit A can be used, or originals of the form can be requested from sample general ledger account numbers Accounting Systems Division, A department can assign its own code within the parameters explained on the form. Once established, any of the department's valid index codes can be used to code any transaction recharges, payroll, etc. When the activity for which an index number has been assigned is terminated, the number must be canceled.

After an index code is canceled sample general ledger account numbers cannot be used for any transaction.

Another index number must be used. It is extremely important that all transactions referencing a given sample general ledger account numbers number have been completed prior to its cancellation, and for this reason the form for requesting the inactivation of an index number is quite lengthy. A copy of the form is in Exhibit B. A copy of the form can be used, sample general ledger account numbers originals requested from the Accounting Systems Division, This form must be used to inactivate any index number, whether assigned by the Accounting Office or the department.