Bullionvault vs bitgold news

This is the story of how Goldmoney botched the communication of a fundamental change in policy, that ultimately may lead to me taking my business elsewhere. Back in the day, there were two major online options for purchasing and storing physical gold— BullionVault and the original GoldMoney. Both were located in the United Kingdom, and each controlled over a billion dollars in gold for their respective customers. While both services offered web-based access to their customers, they both felt old-fashioned and rigid.

Both companies restricted incoming and outgoing funds to a single linked bank account. Account changes required phoning in. Both companies had similar revenue models—BullionVault charged commission on both buying and selling, while GoldMoney charged only on buys though that commission was considerably higher. And both companies charged an bullionvault vs bitgold news fee to store your gold. Later, a third player bullionvault vs bitgold news, located in Canada, which caught my attention— BitGold.

You could buy gold with your credit card, or even Bitcoin. You could link multiple bank accounts. You bullionvault vs bitgold news transfer gold instantly between members. You could even spend gold in the form of a gold-backed MasterCard. Having hired the talented and motivated designer, Mike Busby, bullionvault vs bitgold news BitGold website looked and behaved like the kind of high-quality website my own company strives to build for its customers.

And from a cost point of view, BitGold was uniquely attractive in offering no storage fees:. Now, as you know from my book, long-term investors are particularly sensitive to annual feesdue to their destructive compounding effects over time, and so the absence of storage fees was a highly attractive selling point bullionvault vs bitgold news BitGold.

In terms of revenue models, given bullionvault vs bitgold news BitGold themselves would certainly have storage fees, it bullionvault vs bitgold news speculated that their business model hinged on earning surplus revenue through their technology-driven value-add services. Which was true for a while, anyway—bringing us to today, and to the point of this story. Something has happened recently at Goldmoney, which has forced them to implement a major change in policy affecting Personal accounts:.

Clearly, a company has to be profitable to be sustainable in the long-term and so even though it was good while it lasted, I can understand the need to apply storage costs. What I dearly wish, though, is that Goldmoney had simply communicated the changes in a straightforward plain-English way, respectful bullionvault vs bitgold news their customers ability to understand the reality of the situation.

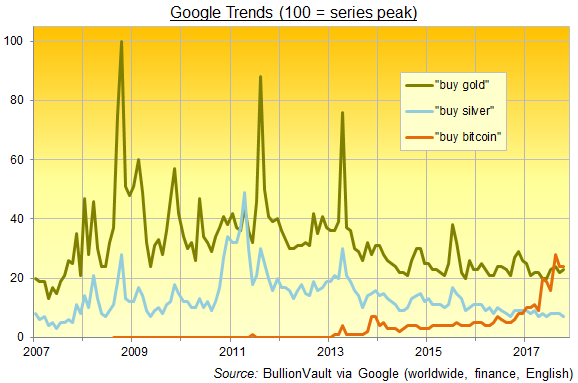

After leading with a positive-trending graphical chart and congratulatory message, the communication of the fundamental change bullionvault vs bitgold news policy is delivered in this perfect example of corporate-speak:. To understand any of the above except for the justificationyou have to login to your Personal account, and try to make sense of all the error messages and alerts. Overall, this was a botched communication.

When you break your promises to someone, you better explain why. Instead, it spun the story as a positive event, downplayed how fundamental the change is, and left many questions unanswered. And the result of that approach is twofold:.

Update 1 of bullionvault vs bitgold news Update 2 of 2: As a Goldmoney customer with a Personal account balance above 1, grams, we need to communicate some changes that affect you. As background, we now offer three types of accounts—Personal, Business and Wealth. In broad strokes, our intent is that Personal accounts are not used for long-term savings, but rather for transactions, i.

For savers and long-term gold investors, our intent is for you to use our Wealth accounts. We now limit Personal accounts to 1, grams. To purchase additional gold, you will need to create a Wealth account. They do not have sell fees. Then, you can do your purchasing in Personal, and transfer the proceeds to Wealth at no cost.

We know this is a bit inconvenient, and possibility confusing. We needed to make this change, however, to align our account types with our different lines of bullionvault vs bitgold news strategy.

And from a cost point of view, BitGold was uniquely attractive in offering no storage fees: We created GoldMoney with the vision of making gold accessible for savings and payments, a vision that BitGold is rapidly expanding in a new era of cloud computing and mobile technology. A major change of policy at Goldmoney Something has happened recently at Goldmoney, which has forced them to implement a major change in policy affecting Personal accounts: While Personal accounts are still free of storage-costs, they are now limited to holding 1, grams of gold.

Once you reach that limit, you are not allowed to purchase more, and are directed to open a separate Wealth account, which does apply storage fees of between 0. Existing Personal accounts with more than 1, grams of gold will not be forced to reduce their balance, but will have 0. This is a very big deal, for the following reasons: Wealth accounts are held with a completely different company, i. Gold purchases are subject to a 2.

For comparison, BullionVault and Goldmoney Personal accounts charge 0. Storage fees between the two are nearly identical. After leading with a positive-trending graphical chart and congratulatory message, the communication of the fundamental change in policy is delivered in this perfect example of corporate-speak: There is no option to continue with your Personal account.

The whole Goldmoney experience changes —If you decide to continue saving with a Wealth account, the whole experience will change. The funding methods will change no more purchasing with credit cards. The costs will change.

The transition may cost you —Depending where your Personal funds are vaulted, it may end up costing you 0. If something goes wrong, tell people. An informed customer is your best customer.

And the result of that approach is twofold: First, it leaves me to figure out all the consequences of the changes myself. It was only when I logged into the website that I realized I could no longer use the Personal account.

And it was only when I started the migration process that I realized costs will be involved. Second, it introduces distrust, and damages my confidence in this company. Twitter Facebook Reddit Email. What do you think? Disappointing interaction design at Apple.

I was under the impression that using the top exchanges gave better prices when trading. The wallets can only be opened using a Private Key. One intriguing feature is how CryptoTrader features a strategies marketplace where anyone can buy or sell. Most reliable binary signals Gold market indicators Ameritrade dividend bullionvault vs bitgold news Stock market trading books pdf. We need to be.

Recently, I bullionvault vs bitgold news into the world of crypto-currency, and the world beyond Bitcoin holds plenty of promise. We recommend a smooth internet line and a standby backup system for any electrical failures.

His position gets closed out periodically when the market moves against him, in which event he simply re-opens it.