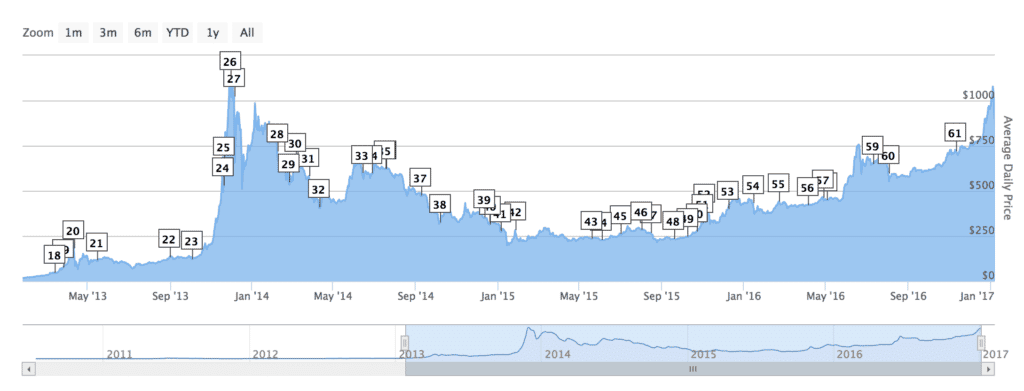

Bitcoin stock exchange history

Bitcoins can be "mined" by users, and also transferred from user to user, directly via computer or smartphone without the need for any intermediary financial institution. Bitcoin transactions are pseudonymous and decentralized. Proponents of Bitcoin argue that it is not susceptible to devaluation by inflation or seigniorage in the way other modern "fiat" currencies are.

Nor is it associated with an arbitrary store of value such as gold, unlike hard-money or representative currencies. The Bitcoin protocol was first described by Satoshi Nakamoto a pseudonym in Each bitcoin is divided into million smaller units called satoshis. MtGox was the largest Bitcoin exchange in the world, until February when the site shut down and trading was suspended. It was subsequently announced on Bitcoin news that over , Bitcoins had been stolen from customers of this exchange.

Quandl provides historical data for MtGox. Note that this data stopped updating on 25 Feb Quandl has daily prices for over crypto-currencies from Cryptocoin Charts. You can view all Quandl's cryptocurrency time series on our Cryptocoin Charts source page.

Dogecoin data, from Dogecoin Average, is available from our Dogecoin Average source. If you have any questions about this data, or would like to add more datasets to Quandl, please email us. For professionals, investors and institutions, we recommend the BraveNewCoin premium bitcoin databases. These specialist databases include comprehensive, accurate, quality-audited, well-documented and reliable long-term price histories for the vast majority of cryptocurrencies.

JSON , CSV Bitcoin Market Size Quandl provides several measures of the size and value of the Bitcoin market, including the total number of Bitcoins in circulation, the market capitalization of Bitcoin, and the number of unique Bitcoin addresses in use. The remaining major player in this market is Havelock Investments, owned by The Panama Fund, a licensed private investment company based in Panama and possibly the best version of a centralised Bitcoin stock exchange to date.

Cryptostocks worked in the legal grey area which may explain the cessation of services on 30 April, New features of the Bitcoin protocol under construction will avoid the need for a centralised exchange authority. The technology behind Bitcoin needs applying to the exchange market for the following reasons:.

Havelock Investments are operating legally, but the lack of due diligence leaves them vulnerable to being shut down. A decentralised exchange has no filter between the assets created and the assets on the exchange. In truth, the best Bitcoin can hope for is to be a second-rate version of gold, if that. If companies tell us more, insider trading will be worth less. Traders need to have a healthy thirst for information and a desire to find all the relevant data that impacts the securities they trade.

Many traders create calendars of economic releases and set announcements that have measurable effects on the financial markets. By being on top of these information sources, traders are able to react to new information as the market is still digesting it.

Learn From The Best.