Bitcoin party draws to a closet

But Bitcoin will not become ubiquitous and trusted until the majority of coins are recycled into the market for payments, settlement, loans, interbank transfers, escrow, contract settlement, etc. It creates a buying opportunity. But what happened last night?

But there are two things that we cannot avoid: It postpones and magnifies a trade imbalance. Bitcoin should not be thought of as an investment. Some would say that the downward pressure is a natural response to law and public policy. It creates a buying opportunity.

Feedback is always welcome. President Obama wants to begin this process while also ensuring that we include universal access to heath insurance. It is adjusting in response to politics, but it almost certainly will return to its historical trend. Gradually, economists, treasury secretaries, reserve board governors and monetary tsars will are coming to the same conclusion. It has terrific shock value.

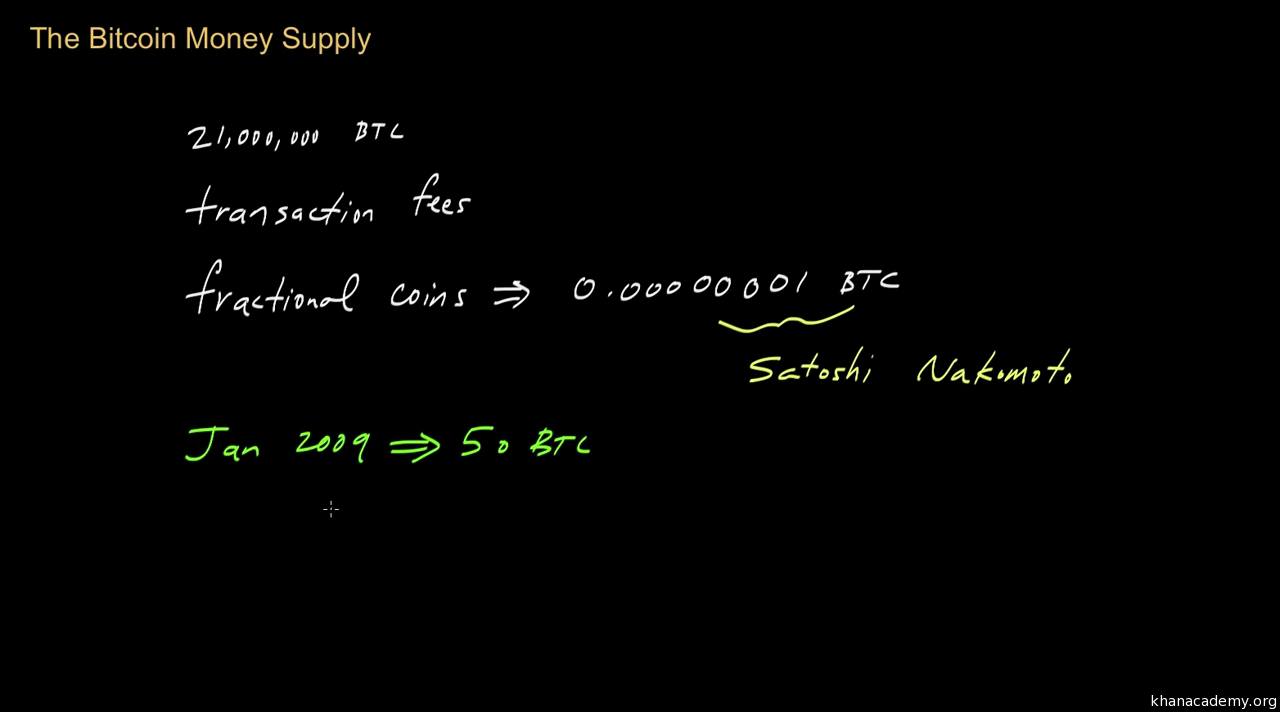

The supply is capped. We got these things, because we handed a pawn broker our marker. Americans delude themselves with the fantasy that that a bitcoin party draws to a closet debtor has cards to play. We get your point of digging in. Their announcement did not ban owning or trading Bitcoins, but it warned citizens that it was a very risky investment and also that it must not be used as currency in any transactions.

Bitcoin has more standing behind it than the US dollar. For example, in this interviewformer fed chairman, Alan Greenspan, explains with remarkable clarity why he believes it is foolish to accept Bitcoin as a currency. The fall was precipitated by a warning from the Chinese government to its citizens. I am a Bitcoin educator, proponent, early adopter and blockchain consultant. Modern 1st world countries cannot forever suppress political and religious freedom.

One way or another, we must still deal with the spiraling cost of health care. Major exchanges have been bankrupt or worse, enormous criminal conspiracies were among the early adopters, the SEC has prohibited the creation of an ETF based on cryptocurrency, rogue spin-off coins are driving a wedge among users, and there are serious problems related to scaling and governance. He bitcoin party draws to a closet that Bitcoin will crash. The US Congress behaves like a whiny child who wants to grab the soccer ball, furlough the players and shut down the stadium. Bitcoin has had a rocky road these first 8 years.

We bitcoin party draws to a closet do want you to enter the community of nations some day. The Party would do better by demanding that routers or firewalls force users to create two keys: Accept that you cannot defund a program that was passed and approved. A core developer sold off his entire BTC savings and claimed that the experiment was a failure. And, we can toss in a prediction.

The supply is capped. The upward path of Bitcoin is already the stuff of legend. Speculation acts against fluidity.

All the while, we soaked up Chinese toys, clothes, gadgets, and raw materials and — of course — Mideast oil. Throughout the 90s and 00s, we moved our manufacturing, infrastructure and innovation off shore. The fall was precipitated by a warning from the Chinese government to its citizens. The recent pullback has no fundamental basis.