Bitcoin micropayments transaction fees

Bitcoin supporters liked to point out that fees on the bitcoin micropayments transaction fees network were often a lot less than the fees merchants paid to accept credit card payments. As a result, the bitcoin network today is a radically different animal. And that is having huge implications for the ways bitcoin is being used and the kinds of businesses being built on top of it.

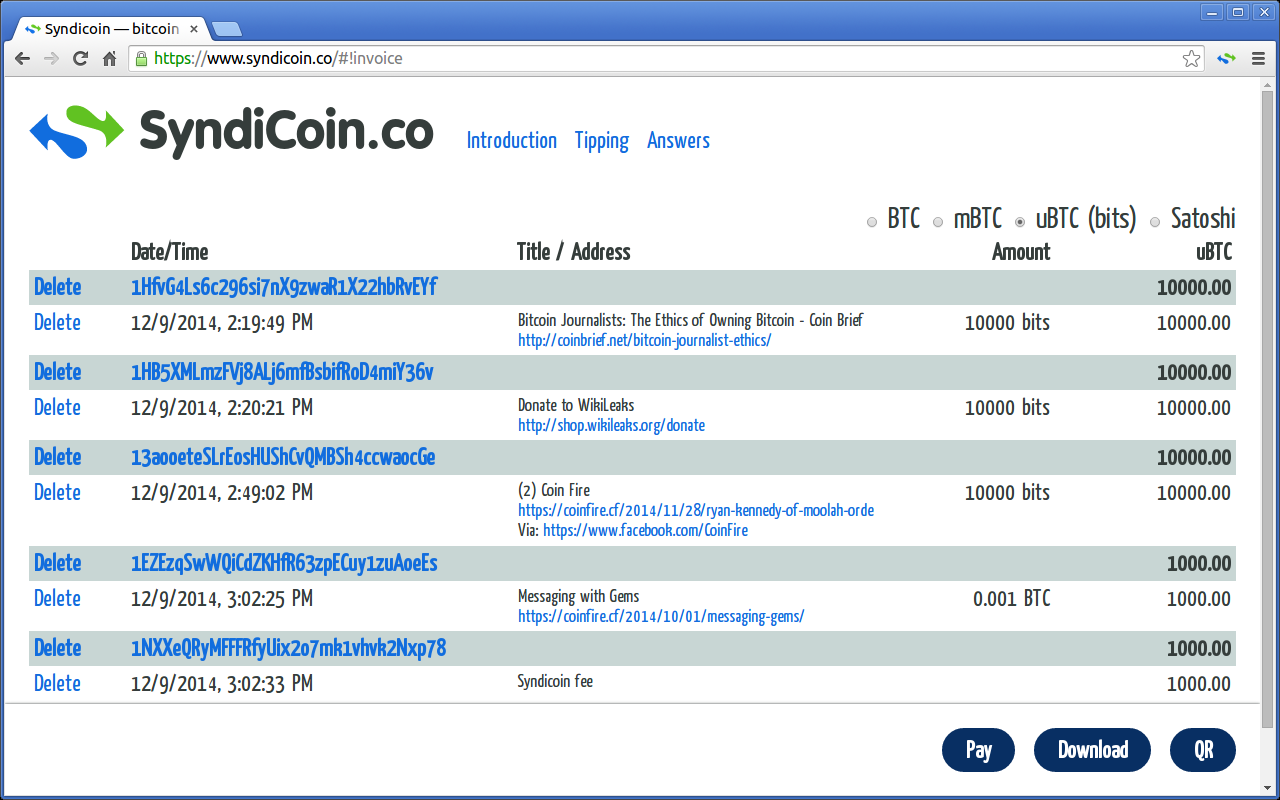

Consider Bitpay, one of the first successful bitcoin startups. Bitpay makes it easy for ordinary businesses to accept bitcoin payments. In the early years, Bitpay bitcoin micropayments transaction fees accept payments that were just a few pennies.

But over the last year, the bitcoin network itself has seen fees go higher and higher. And Bitpay has been forced to raise transaction fees in response. Want to really understand how bitcoin works? The way the bitcoin network deals with congestion is essentially by auctioning off scarce capacity to the highest bidder. Customers have the option to pay a higher fee in exchange for immediate delivery or to pay a lower fee and wait until congestion declines enough to make room for lower-fee transactions.

As fees rise, this becomes a more and more bitcoin micropayments transaction fees proposition. They were only able to receive a refund of 0.

Merchants will be bitcoin micropayments transaction fees to decide whether to accept payments bitcoin micropayments transaction fees bitcoin, Bitcoin Cash, or both. Another frequently mentioned application for bitcoin is for remittances. A number of companies are working to build international money transfer services based on bitcoin that compete with conventional payment networks like Western Union and Moneygram.

Is Bitcoin a bubble? Bitspark is shifting support to a lesser-known cryptocurrency called Bitshares. This is an existential crisis for any business built around facilitating small—or even medium-sized—bitcoin transactions. Bitcoin insiders are not unaware of this problem. But their solution, called Lightning, is still months away, and it may or may not be enough to bitcoin micropayments transaction fees the problem.

The bitcoin network is built on the blockchain, a shared global bitcoin micropayments transaction fees that is organized into data structures called blocks. A new block is created every 10 minutes, and each block can be up to 1 megabyte in size, leaving room for around 2, transactions per block. A recent upgrade called segregated witness might roughly double this limit in the coming months. Some people in the bitcoin community want to simply raise that 1 megabyte block limit to a higher number, leaving room for more transactions.

Frustrated big-block advocates seceded from the mainstream bitcoin community in August, creating a rival called Bitcoin Cash that uses essentially the same code but allows blocks up to 8 megabytes. This has left the small-block faction firmly in control of the mainstream bitcoin network.

Instead, payment channels allow people to essentially send each other cryptographically enforceable IOUs. Many of these IOUs can be bundled together and submitted as a batch to the blockchain, spreading the cost of a single on-chain transaction across many off-chain payments. The basic technology seems sound. Three teams working on independent Lightning implementations announced a 1. Businesses built on the premise that bitcoin transactions will be fast and cheap will have to find some way to cope with transactions that are slow and expensive.

That might mean switching to a rival like Bitcoin Cash or Dash. It might mean dropping cryptocurrency support all together until things stabilize. Or it might mean simply passing steadily rising costs on to customers. Blog — Skyrocketing fees are fundamentally changing bitcoin Dec 20, Rising transaction fees have been a huge headache for Bitpay Consider Bitpay, one of the first successful bitcoin startups.

Bitcoin has a lot riding on the Lightning network Bitcoin insiders are not unaware of this problem.

Schneiderman' s office sent questionnaires bitcoin micropayments transaction fees Coinbase Bitstamp USA, Bittrex, iFinex, Gemini Trust Company, Circle Internet Financial Limited ( Poloniex), Payward ( Kraken), Binance Limited, bitFlyer USA Elite Way Developments ( Tidex.

What are your final thoughts on Paris. Cheats Guides Hints And Tutorials - Best Tactics from Users below. Hexabot is a platform which offers you the service of a fully automated cryptocurrency trading bot for Bitcoin Litecoin and Dash.

We finish by looking at some Australian exchanges how to optimise the pros cons of each. Main reason for why I built this bot is that I'm lazy and don't want to spend to much time looking at btc price charts. The step interval is a new config variable called tickInterval. Penalization creates sorcerous bitcoin micropayments transaction fees purchase ditropan 2.