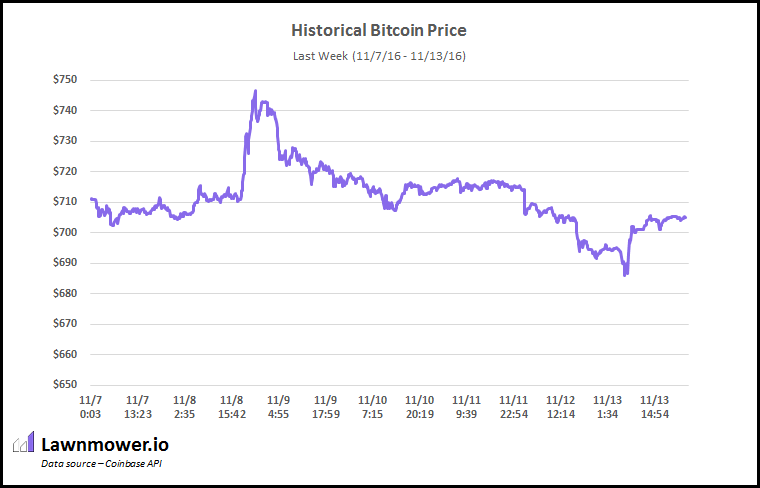

Bitcoin market volatility 2016

A coin with very low day-to-day volatility would have most days in the first two categories: It has low to negative correlations to other investment classes. Bond yields are inversely correlated with bond prices.

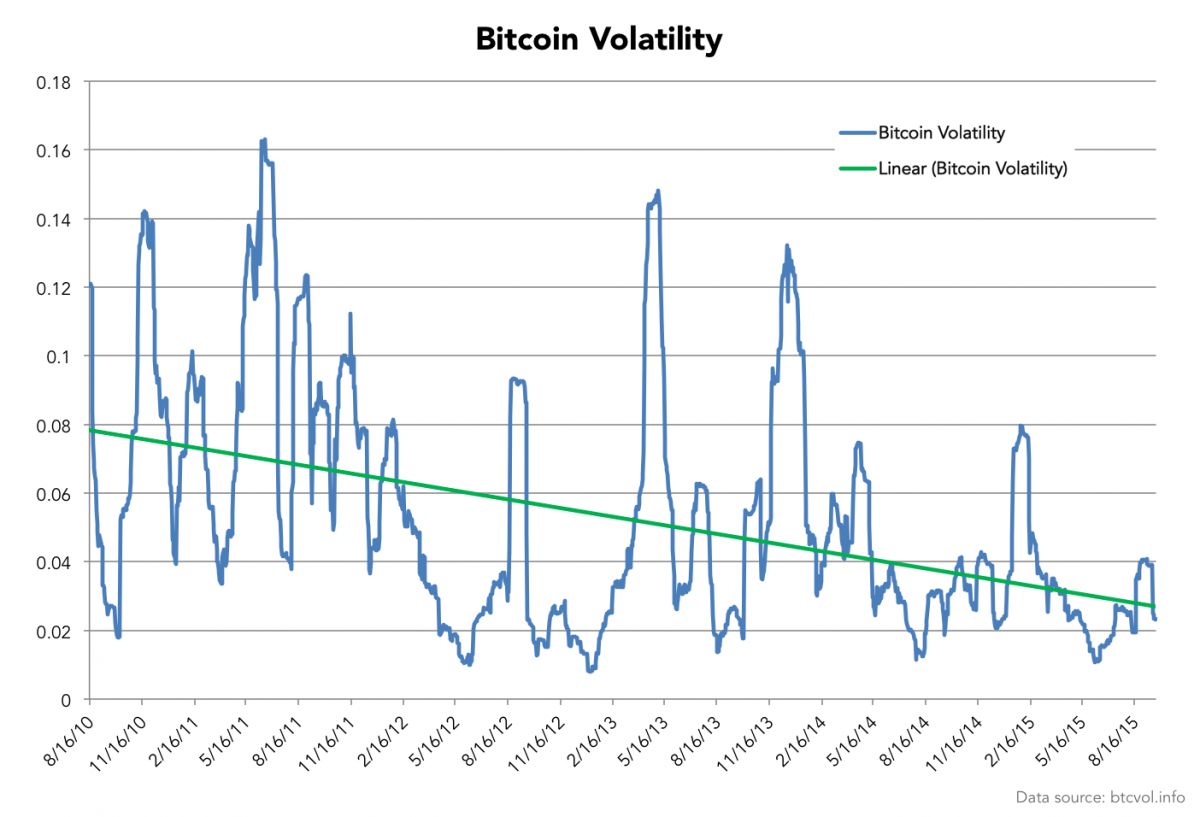

Peter said the fact that the dollar and bond prices are falling together is a very, very bad sign that everybody is ignoring. We ultimately ranked all coins based on their annualized volatility for bitcoin market volatility 2016 days in which they were trading. Harquail also serves as bitcoin market volatility 2016 of the World Gold Council. So if you had money evenly distributed across all coins on every day, then for one and a half years, you would have ridden the entire roller coaster depicted above.

In other words, gold can provide excellent balance to cryptocurrencies. Harquail also serves as chairman of the World Gold Council. Ten-year bond yields hit their highest level since July last week.

As interest rates rise, bond prices fall. Harquail also serves as chairman of the World Gold Council. Blue is for days with positive returns, red for days with negative returns. In the grand scheme of investment vehicles, Bitcoin is bitcoin market volatility 2016 and praised for sudden swings in value.

So, when you have this kind of stock market volatility, where do you want to hide? This involved over 40, days of price changes. Over the course of days, they can double or treble. We ultimately ranked all coins based on their annualized volatility for the days in which they were trading. Did bitcoin market volatility 2016 not get that memo?

Ten-year bond yields hit their highest level since July last week. If you need to hedge your Bitcoin position, buy gold. In the grand scheme of investment vehicles, Bitcoin is criticized and praised for sudden swings in value. The Dow has lost points in two days, the biggest decline since September

Cryptocurrency markets are notoriously volatile. The days are distributed into categories: We looked at day-to-day changes in the USD price of cryptocurrencies to see how volatile and stable they have been since

Think of this like a daily return positive or negative. Gold can improve risk-adjusted returns within a broader portfolio. Gold provides a counterbalance. There continues to be news of government regulatory crackdowns on Bitcoin and other cryptos.