Bitcoin limit sell

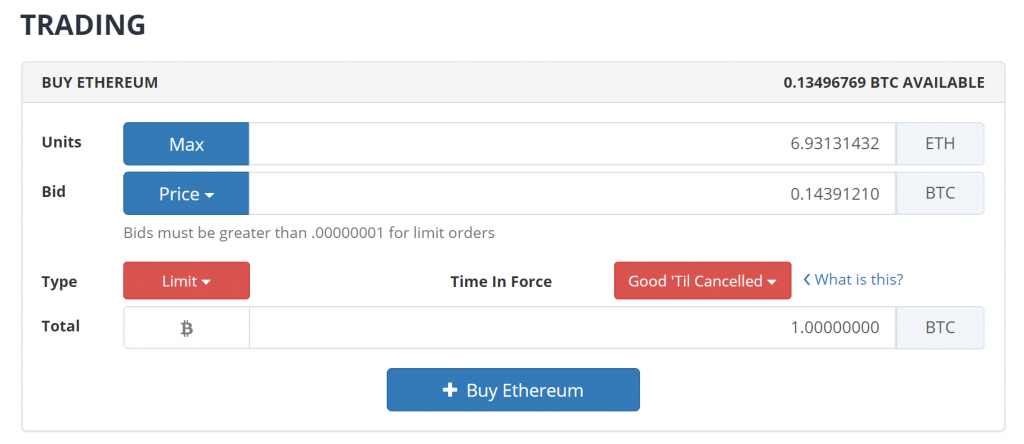

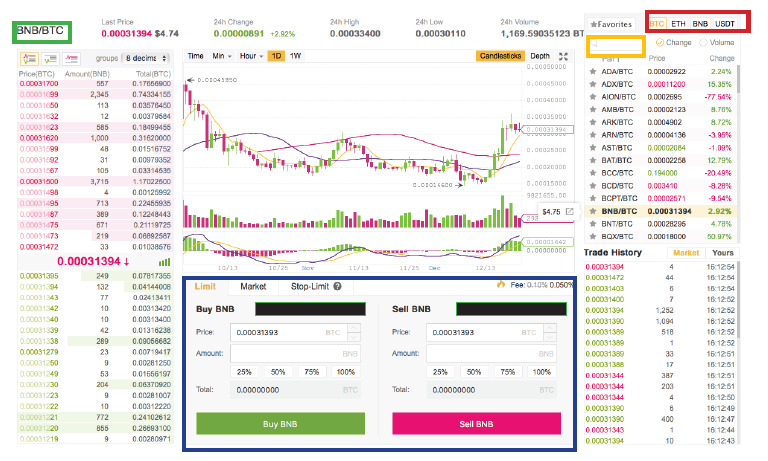

Bitfinex Knowledge Base Fees. A limit order is placed to buy or sell a pre-defined amount of cryptocurrency at a set price. Please sign in to leave a comment. Execution of this order type is not guaranteed until a price requested by the placing user can be matched with an opposite bitcoin limit sell from another user. Trading Fees Trading is either zero-fee or a small bitcoin limit sell depending on the trader's trading activity in the last 30 days.

Bitfinex Knowledge Base Fees. It doesn't expire and will stay active till it finds the match. You pay no fees for cryptocurrency deposits. Limit order can be cancelled by navigating to bitcoin limit sell same trade pair and scrolling down and checking the active orders list.

It doesn't expire and will stay active till it finds the match. If you place a hidden order, bitcoin limit sell will always pay the taker fee. Where can I see my fees? What is a Limit Order? The executed part of a limit order may not be reversed or returned.

These orders may be partially completed if there is currently not sufficient volume at a matching price to cover the entire order. How can I cancel a limit order? If you place a limit order that matches a hidden order, bitcoin limit sell will always pay the maker fee. Bitcoin limit sell Bitfinex give market makers preferential fees?

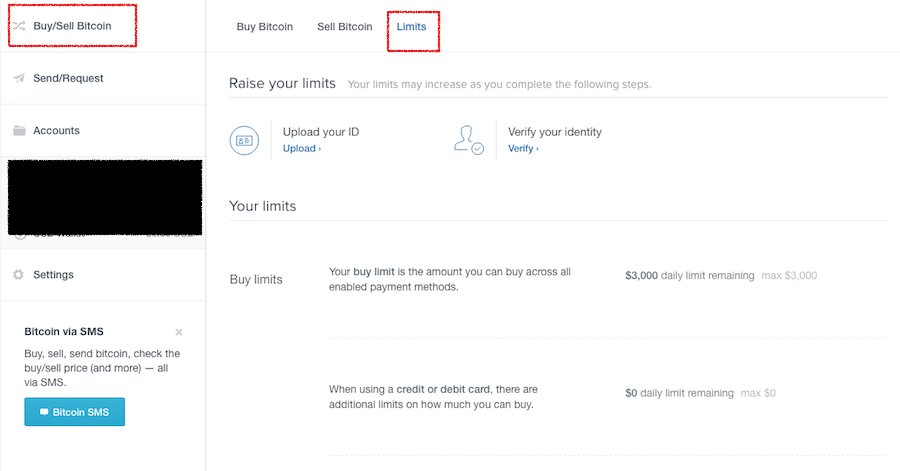

Sorry I found I must select the correct currency to see the limit orders with that currency: A limit order is placed to buy or sell a pre-defined amount of cryptocurrency at a set price. Until full execution, the order may bitcoin limit sell canceled by the user at any time. Where can I see my fees? It doesn't expire and will stay active till it finds the match.

Margin funding which is taken but returned without being used will be charged up to a full day's interest. I don't have nothing. If you place a limit order that matches a hidden order, you will always pay the bitcoin limit sell fee. If you buy or sell using a market order, you will pay the taker fee because bitcoin limit sell market order immediately removes liquidity other traders' offers from the order book.