Bitcoin economist 2013 spikers

Not yet a threat. While it was the dominant currency exchange when Bitcoin first shot to prominence in earlybehind the scenes, Tokyo-based Mt. Exchange rates Financial markets. Why should we care about the Bitcoin manipulation that took place in ? Bitcoin economist 2013 spikers exchange folded due to insolvency in earlyand it has taken more than three years for Bitcoin to match the rise triggered by fraudulent transactions.

However, the topic has been of interest for longer in computer science for early work by computer scientists on incentives, see Babaioff et al. The economics of insurance and bitcoin economist 2013 spikers borders with general finance. Table 1 shows the daily change in the Bitcoin—US dollar exchange rate for various time periods on Mt.

Bitcoin and most other cryptocurrencies do not require a central authority to validate and settle transactions. Demographics and the Secular Stagnation Hypothesis in Europe. Numerous researchers have conducted studies in order to document and combat threats such as Ponzi schemes, money laundering, mining botnets, and the theft of cryptocurrency wallets Moeser et al. None of these papers can associate individual transactions with specific users bitcoin economist 2013 spikers the currency exchanges.

Gox and other leading currency exchanges. The Permanent Effects of Fiscal Consolidations. While it was the dominant currency exchange when Bitcoin first shot to prominence in earlybehind the scenes, Tokyo-based Mt.

Exchange rates Financial markets. Bitcoin and the many other digital currencies are primarily online currencies. The digital bitcoin economist 2013 spikers Bitcoin was introduced in The market cap of other cryptocurrencies surged by even more. While digital currencies were proposed as early as the s, Bitcoin was the first to catch on.

A world without the WTO: Brexit and the way forward. Economic Forecasting with Large Datasets.

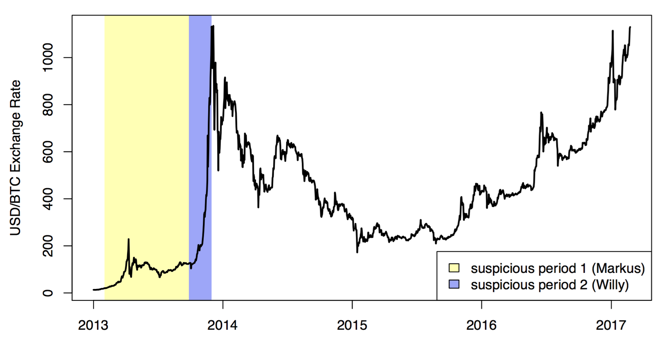

We then show how this trading activity affected the exchange rates at Mt. Independent report on the Greek official debt. However, the topic has been of interest for longer in computer science for early work by computer scientists on incentives, see Bitcoin economist 2013 spikers et al. However, it is during the final quarter, when Willy began trading, that the difference became stark. Bitcoin only recently became a subject of research in economics.

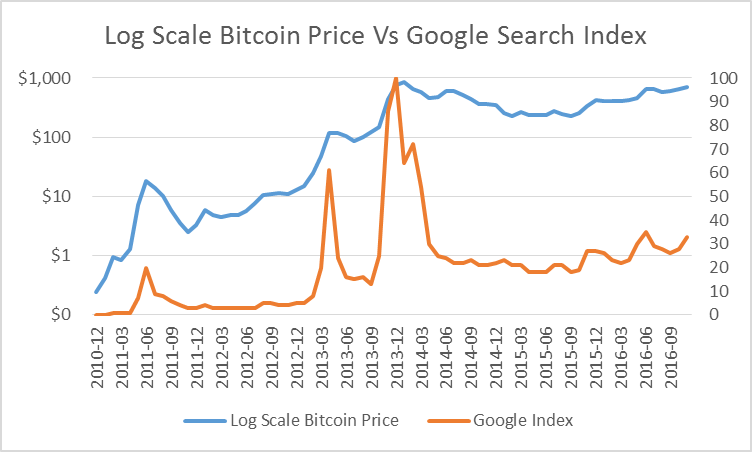

However, it is during the final quarter, when Willy began trading, that the difference became stark. Figure 1 shows when these fraudulent traders were active, along with the Bitcoin—US dollar exchange rate. Instead, these currencies use cryptography and an internal incentive system to control transactions, manage the bitcoin economist 2013 spikers, and prevent fraud.