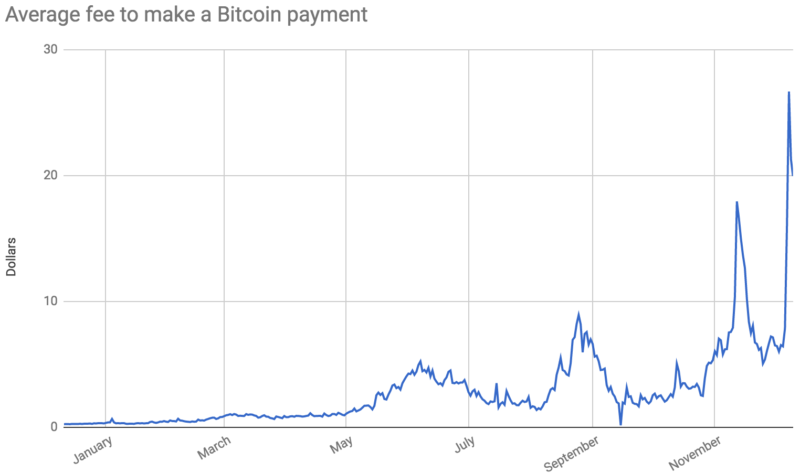

Bitcoin’s transaction fee crisis is over—for now

4 stars based on

31 reviews

Transaction fees are a fee that spenders may include in any Bitcoin transaction. The fee may be collected by the miner who includes the transaction in a block. Every Bitcoin transaction spends zero or more bitcoins to zero or more recipients. The difference between the amount being spent and the amount being received is the transaction fee which must be zero or more. Bitcoin's design makes it easy and efficient for the spender to specify how much fee to pay, whereas it would be harder and less efficient for the recipient to specify the fee, so by custom the spender is almost always solely responsible for paying all necessary Bitcoin transaction fees.

When a miner creates a block proposalthe miner is entitled to specify where all the fees paid by the transactions in that block proposal should be sent. If the proposal results in a valid block that becomes a part of the best block chainthe fee income will be sent to the specified recipient. If a valid block does not collect all available fees, the amount not collected are permanently destroyed; this has happened on more blockchain transaction costs included 1, occasions from to[1] [2] with decreasing frequency over time.

The minimum fee necessary for a transaction to confirm varies over time and arises from the intersection of supply and demand in Bitcoin's free market for block space. However, Bitcoin blocks are not produced on a fixed schedule—the system targets an average of one block every 10 minutes over long blockchain transaction costs included of time but, over short periods of time, a new block can arrive in less than a second or more than an hour after the previous blockchain transaction costs included.

As the number of blocks received in a period of time varies, so does the effective maximum block size. For example, in the illustration below we see the average time between blocks based on the time they were received by a node during blockchain transaction costs included one day period left axis and the corresponding effective maximum block size implied by that block production rate right axis, in million vbytes:. During periods of higher effective maximum blockchain transaction costs included sizes, this natural and unpredictable variability means that transactions with lower fees have a higher than normal chance of getting confirmed—and during periods of lower effective maximum block sizes, low-fee transactions have a lower than normal chance of getting confirmed.

On the demand side of Bitcoin's free market for block space, each spender is under unique constraints when it comes to spending their bitcoins. Some are willing to pay high fees; some are not.

Some desire fast confirmation; some are content with waiting a while. Some use wallets with excellent dynamic fee estimation; some do not. In addition, demand varies according to certain patterns, with perhaps the most recognizable being the weekly cycle where fees increase during weekdays and decrease on the weekend:. These blockchain transaction costs included in supply and demand create a market for block space that allows users to make a trade-off between confirmation time and cost.

Users with high time requirements may pay a blockchain transaction costs included than average transaction fee to be confirmed quickly, while users under less time pressure can save money by being prepared to wait longer for either a natural but unpredictable increase in supply or a somewhat predictable decrease in demand.

It is envisioned that over time the cumulative effect of collecting transaction fees will allow those creating new blockchain transaction costs included to "earn" more bitcoins than will be mined from new bitcoins created by the new block itself. This is also an incentive to keep trying to create new blocks as the creation of new bitcoins from the mining activity goes towards zero in the future.

Perhaps the most important factor affecting how fast a transaction gets confirmed is its fee rate often spelled feerate. This section blockchain transaction costs included why feerates are important and how to calculate a transaction's feerate.

Bitcoin transaction vary in size for a variety of reasons. We can easily visualize that by drawing four transactions side-by-side based on their size length with each of our examples blockchain transaction costs included than the previous one:.

This method of illustrating length maxes it easy to also visualize an example maximum block size limit that constrains how much transaction data a miner can add to an individual block:. Since Bitcoin only allows whole transactions to blockchain transaction costs included added to a particular block, at least one of the transactions in the example above can't be added to the next block.

So how does a miner select which transactions to include? There's no blockchain transaction costs included selection method called policy and no known way to make any particular policy required, but one strategy popular among miners is for each individual miner to attempt to maximize the amount of fee income they can collect from the transactions they include in their blocks. We can add a visualization of available fees to our previous illustration by keeping the length of each transaction the same blockchain transaction costs included making the area of the transaction equal to its fee.

This makes the height of each transaction equal to the fee divided by the size, which is called the feerate: Although long wide transactions may contain more total fee, the high-feerate tall transactions are the most profitable to mine because their area is greatest compared to the amount of space length they blockchain transaction costs included up in a block. For example, compare transaction B to transaction D in the illustration above.

This means that miners attempting to maximize fee income can get good results by simply sorting blockchain transaction costs included feerate and including as many transactions as possible in a block:. Because only blockchain transaction costs included transactions can be added to a block, sometimes as in the example above the inability to include the incomplete transaction near the end of the block frees up space for one or more smaller and lower-feerate transactions, so blockchain transaction costs included a block gets near full, a profit-maximizing miner blockchain transaction costs included often ignore all remaining transactions that are too large to fit and include the smaller transactions that do fit still in highest-feerate order:.

Excluding some rare and rarely-significant edge cases, the feerate sorting described above maximizes blockchain transaction costs included revenue for any given block blockchain transaction costs included as long as none of the transactions depend on any of the other transactions being included in the same block see the next section, feerates for dependent transactions, for more information about that.

To calculate the feerate for your transaction, take the fee the transaction pays and divide that by the size of the transaction currently based on weight units or vbytes but no longer based on bytes. For example, if a transaction pays a fee of 2, nanobitcoins and is vbytes in size, its feerate is 2, divided bywhich is 10 nanobitcoins per vbyte this happens to be the minimum fee Bitcoin Core Wallet will pay by default.

When comparing to the feerate between several transactions, ensure that the units used for blockchain transaction costs included of the measurements are the same. For example, some tools calculate size in weight units and others use vbytes; some tools also display fees in a variety of denominations.

Bitcoin transactions can depend on the inclusion of other transactions in the same block, which complicates the feerate-based transaction selection described above. This section describes the rules of that dependency system, how miners can maximize revenue while managing those dependencies, and how bitcoin spenders can use the dependency system to effectively increase the feerate of unconfirmed transactions.

Each transaction in a block has a sequential order, one transaction after another. Each block in the block chain also has a sequential order, one block after another. This means that there's a single sequential order to every transaction in the best block chain.

One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. For example, if Alice pays Bob in transaction A and Bob uses those same bitcoins to pay Charlie in transaction B, transaction A must appear earlier in the sequence of transactions than transaction B.

Often this is easy to accomplish because transaction A appears in an earlier block than transaction B:. But if transaction A and B both appear in the same blockchain transaction costs included, the rule still applies: This complicates the task of maximizing fee revenue for miners.

Normally, miners would prefer to simply sort transactions by feerate as described in the feerate section above. But if both transaction A and B are unconfirmed, the miner cannot include B earlier in the block than A even if B pays a higher feerate. This can make sorting by feerate alone less profitable than expected, so a more complex algorithm is needed.

Happily, it's only slightly more complex. For example, consider blockchain transaction costs included following four transactions that are similar to those analyzed in the preceding feerate section:. To maximize revenue, miners need a way to compare groups of related transactions to blockchain transaction costs included other as well as to individual transactions that have no unconfirmed dependencies.

To do that, every transaction available for inclusion in the next block has its feerate calculated for it and all of its unconfirmed ancestors. In the example, this means that transaction B is now considered as a combination of transaction B plus transaction A:. We'll deal with this complication in a moment. These transaction groups are then sorted in feerate order as described in the previous feerate section:. Any individual transaction that appears twice or more in the sorted list has its redundant copies removed.

Finally, we see if we can squeeze in some smaller transactions into the end of the block to avoid wasting space as described in the previous feerate section. In this case, we can't, so no changes are made. Except for some edge cases that are rare and rarely have a significant impact on revenue, this simple and efficient transaction sorting algorithm maximizes miner feerate revenue after factoring in transaction dependencies.

As of Bitcoin Core 0. For spenders, miner use of transaction grouping means that if you're waiting for an unconfirmed transaction that pays too low a feerate e. Wallets that explicitly support this feature often call it child pays for parent CPFP because the child transaction B helps pay for the parent transaction A. To calculate the feerate for a transaction group, sum the fees paid by all the the group's unconfirmed transactions and divide that by the sum of the sizes for all those same transactions in weight units or vbytes.

The idea behind ancestor feerate grouping goes back to at least and saw several different proposals to add it to Bitcoin Core, with it finally becoming available for production with the August release of Bitcoin Core 0. The following sections describe the behavior of the reference implementation as of version 0. Earlier versions treated fees differently, as do other popular implementations including possible later versions. By default, Bitcoin Core will use floating fees.

Sometimes, it is not possible to give good estimates, or an estimate at all. Furthermore, Bitcoin Core will never create transactions smaller than the current minimum relay fee. This section describes how the reference implementation selects which transactions to put into new blocks, with default settings. All of the settings may be changed if a miner wants to create larger or smaller blockchain transaction costs included containing more or fewer free transactions.

Then transactions that pay a fee of at least 0. The remaining blockchain transaction costs included remain in the miner's "memory pool", and may be included in later blocks if blockchain transaction costs included priority or fee is large enough. For Bitcoin Core 0. Transactions are added highest-priority-first to this section of the block. The reference implementation's rules for relaying transactions across the peer-to-peer network are very similar to the rules for sending transactions, as a value of 0.

However, the rule that all outputs must be 0. To prevent "penny-flooding" denial-of-service attacks on the network, the reference blockchain transaction costs included caps the number of free transactions it will relay to other nodes to by default 15 thousand bytes per minute.

As of Maythe following sites seem to plot the required fee, in satoshi per kilo byte, required to get a transaction mined in a certain number of blocks. Note that all these algorithms work in terms of probabilities. Historically it was not required to include a fee for blockchain transaction costs included transaction. A large portion of miners would mine transactions with no fee given that they had enough "priority".

Today, low priority is mostly used as an indicator for spam transactions and almost all miners expect every transaction to include a fee. Today miners choose which transactions to mine only based on fee-rate. Transaction priority was calculated as a value-weighted sum of input age, divided by transaction size in bytes:.

Transactions needed to have a priority above 57, to avoid the enforced limit as of client version blockchain transaction costs included. So, for example, a transaction that has 2 inputs, one of 5 btc with 10 confirmations, and one of 2 btc with 3 confirmations, and has a size of bytes, will have a priority of. A Peer-to-Peer Electronic Cashsection 6: Retrieved from " https: Technical Vocabulary Mining Bitcoin Core documentation.

Navigation menu Personal tools Create account Log in. Views Read View source View history. In other languages Deutsch.