Gambit bitcoin wiki

32 comments

Bitcoin tax compliance

I mean it should right? The answer is simple: Bitcoin, and crypto-currencies in general, are becoming mainstream and lots of the new money that used to come into safe haven assets is going into crypto now. The more time passes and the longer these coins survive, the more trusted they become, the more people find out about them and use them as a store of value and an easy way to transfer money across the Internet, as well as for the many other applications that are coming in the future.

Gold keeps stagnating as Bitcoin prices go up. Image courtesy of http: The costs of storing it, holding it or transferring it actually make no sense to new generations. When I played the video the first thing I see is a Charlie Shrem comercial about Bitcoin, granted, this is likely based on my viewing habits but still epic!

The comments on his videos are really amusing, people are making trolling Peter a new internet sport, similar to trolling Shia Labeouf a few months ago…. Does he not realize the more he talks about it, the more his followers will discover Bitcoin and cryptocurrencies and choose to diversify their holdings?

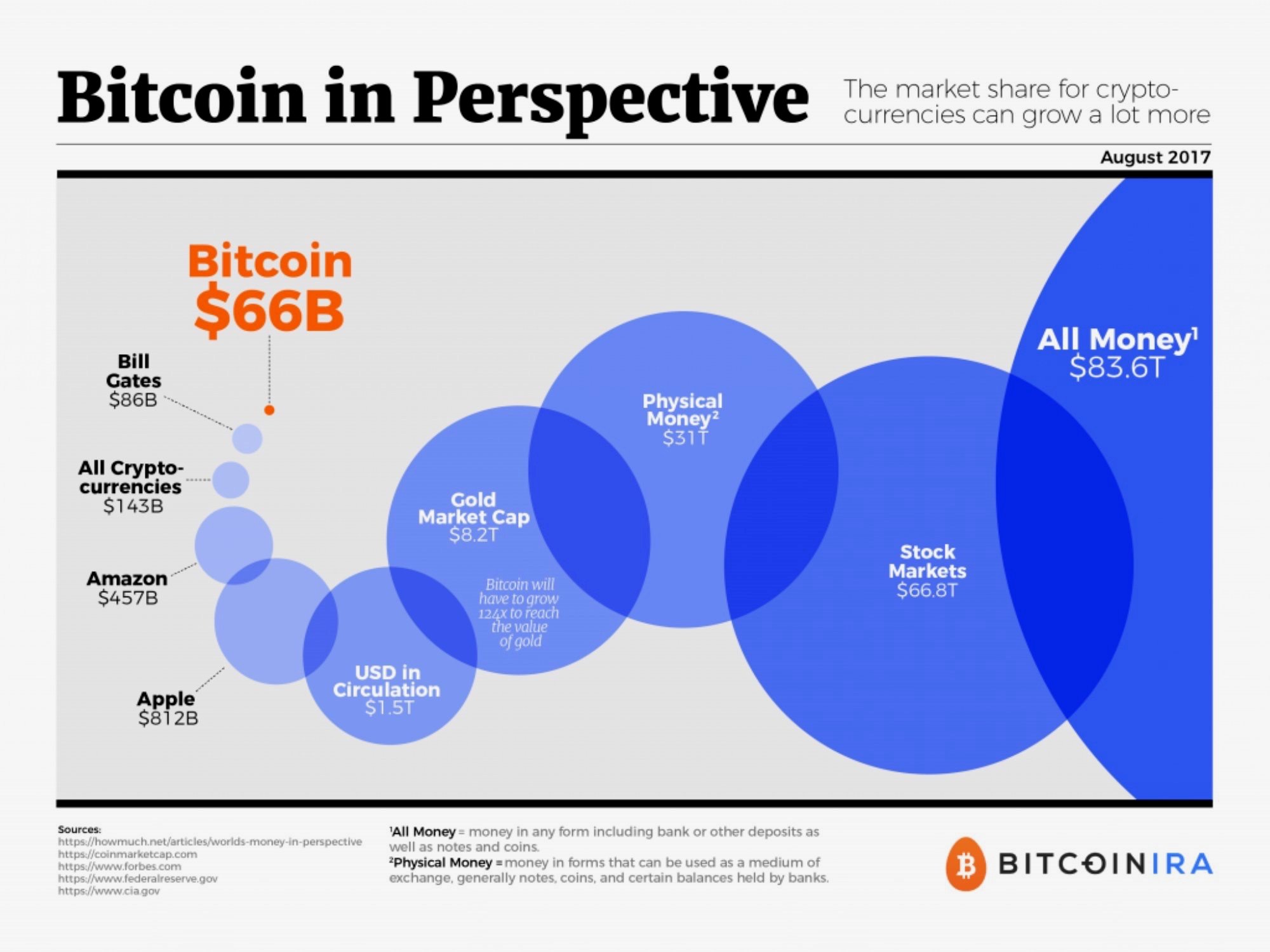

Also, the more he gets triggered by trolls, the more they will come to his channel to get funny reactions from him and his followers. If we compare Crypto and Gold market caps to communicating vessels, we see that Crypto still has a long way to go. What will likely happen is that volume rushing in will surpass the medium level and fluctuate back and forth until they reach an equilibrium, so we could see even more than 50x increases in price for a while.

Google Trends comparison A Google Trends comparison shows Bitcoin searches are still small compared to Gold but Bitcoin's long term trend is up while Gold's is either stagnating or going down. Eventually, I believe both Gold and Crypto will increase tremendously in price because we are overdue for a major financial crisis in the United States and, subsequently, the world.

Price increases will happen, not only because they will both be more in demand, but because fiat currencies, in particular the dollar, will be greatly devalued by politicians to combat the crisis in their typically keynesian ways.

Because of its abundant supply Gold will probably increase about 2x or 3x, but its purchasing power will likely remain about the same. Crypto, being less abundant the top coins , and also by stealing some of the thunder from precious metals, will likely go up 50X or more in future years as a deep crisis finally materializes after 8 years of easy FED money inflating bubbles everywhere.

What percentage should you invest in each cryptocurrency to become a multimillionaire? A guaranteed winning strategy. Market is entering a bear market. Crypto and Gold expected to soar! He is talking about this non-nuclear but incredibly powerful weapon! Tell me what you think about this post in the comments below. This is not professional investment advise. I'm not your financial advisor. Only invest money you can afford to lose! Interesting article to compare the market of gold versus to bitcoin.

Gold will not disappear and should coexist in the future with BTC. When the most successful investor around doesn't advocate gold, you know there are better places to put your money. Warren Buffet knows what he's talking about.

He learned from the best, Ben Graham, and I'm learning from both of them. Check out my strategy based on their teachings about passive indexing: Both are better than holding dollars. However gold is superior because central banks use it to back government debt. Lots of government debt out there You have completed some achievement on Steemit and have been rewarded with new badge s:.

Award for the number of upvotes Award for the number of upvotes received. Click on any badge to view your own Board of Honor on SteemitBoard. For more information about SteemitBoard, click here. If you no longer want to receive notifications, reply to this comment with the word STOP. By upvoting this notification, you can help all Steemit users.

Click here to read more! The comments on his videos are really amusing, people are making trolling Peter a new internet sport, similar to trolling Shia Labeouf a few months ago… Does he not realize the more he talks about it, the more his followers will discover Bitcoin and cryptocurrencies and choose to diversify their holdings?

Communicating vessels analogy If we compare Crypto and Gold market caps to communicating vessels, we see that Crypto still has a long way to go. Google Trends comparison A Google Trends comparison shows Bitcoin searches are still small compared to Gold but Bitcoin's long term trend is up while Gold's is either stagnating or going down Financial Crisis will bring Gold Bugs and Crypto investors together Eventually, I believe both Gold and Crypto will increase tremendously in price because we are overdue for a major financial crisis in the United States and, subsequently, the world.

Most Gold bugs will eventually capitulate and diversify into crypto, including Peter Schiff… Check out my previous posts: Authors get paid when people like you upvote their post.

I like the humor in your article. You may have a point but gold has and always will be seen as real money, good read cheers. I'm not saying Gold will go away. It will always stay around but so will the blockchain.

Both gold and crypto is great choice among all this worthless paper! BTC took gold easly. Now, 11 days later is 3 times more in value: That's exactly what I think. Gold bugs and Crypto investors are in this together.

When the most successful investor around doesn't advocate gold, you know there are better places to put your money http: You have completed some achievement on Steemit and have been rewarded with new badge s: Award for the number of upvotes Award for the number of upvotes received Click on any badge to view your own Board of Honor on SteemitBoard. For more information about SteemitBoard, click here If you no longer want to receive notifications, reply to this comment with the word STOP By upvoting this notification, you can help all Steemit users.

Why is it always 'Goldbugs'? I never hear the term 'Cryptobugs': Because I haven't heard the term yet. Wanna coin it for posterity?

We can make a post about it and share it with the world.