Update: VISA issuers and Mastercard make it harder to buy Bitcoin and other cryptocurrencies

5 stars based on

74 reviews

That's how much it'd cost me to send 0. And this is actually quite cheap compared to a few days ago, when transaction fees were even higher, making Bitcoin barely usable for microtransactions. And cheap transactions, especially for small amounts of BTC, are supposedly one of Bitcoin's biggest advantages. Yes, you can now tip strippers with Bitcoin. The transaction fees are raging due to several factors. One is the size of the block in Bitcoin's blockchain, which is limiting the number of transactions that can go through at any given time.

Bitcoin's network is powered by miners, people and companies who use a tremendous amount of computing power to create new bitcoins. And when there's too many transactions to process—which currently happens very often—miners will prioritize transactions that pay a higher fee.

The situation improved with the recent SegWit upgrade of the Bitcoin software, but it will take a while—weeks or months—before users start seeing benefits of SegWit. Another reason is Bitcoin Cash, a competing cryptocurrency that split off from Bitcoin on August 1. Since the two cryptocurrencies are similar, it's simple for miners to switch from mining Bitcoin to Bitcoin Cash. And for reasons explained heresometimes it's more profitable to mine Bitcoin Cash than Bitcoin.

Whenever miners start switching to Bitcoin Cash, Bitcoin's network becomes slower, and transaction fees rise; we've seen this swing happen a couple of times before and it's likely to keep happening for a while. This is not good for Bitcoin. A few bucks or even a few dozen bucks per transaction isn't a deal breaker for investors, but for someone who wants to use Bitcoin as payment—which is kind of the point of Bitcoin in the first place—that's far too expensive.

The good news is that the fees are likely to get better. The bad news is that it won't happen very soon. SegWit has paved the way for a further upgrade called the Lightning Networkwhich should vastly reduce fees, but the software, or even its specifications, bitcoin android app transaction fee ready yet.

This will reduce strain on the network and make transaction fees lower, but switching to SegWit2x requires a so-called hard fork, meaning that Bitcoin is once again splitting into two, which could bring new trouble. Luckily, Bitcoin android app transaction fee users aren't completely without options right now. One thing you can do is wait until the network is less strained at bitcoin android app transaction fee, during the weekendwhich is when transaction fees will go down.

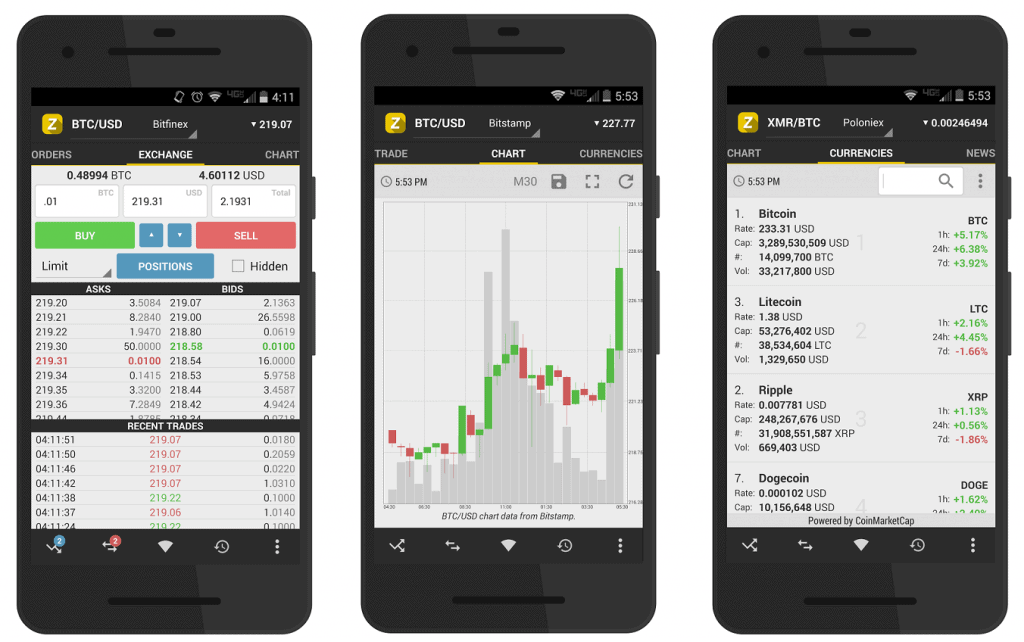

You can also check this service to see which transaction fees are currently the most economic for you. At the time of this writing, a Bitcoin fee of satoshis per byte will be enough for your transaction to go through in about 30 minutes Bitcoin transaction fees are expressed in satoshiswhich is one hundred millionth of a Bitcoin, per byte size of the transaction, which is typically a little over bytes.

Have in mind that fee estimators aren't perfect; an alternative service that shows you the currently optimal fee is this one. Paying a fee that's too high is unnecessary, as it doesn't carry any additional benefit. But paying too small a fee means your transaction won't go through fast, or at all. This information won't help you much bitcoin android app transaction fee you use a wallet that doesn't let you change transaction fees, so maybe it's time to switch to a different wallet.

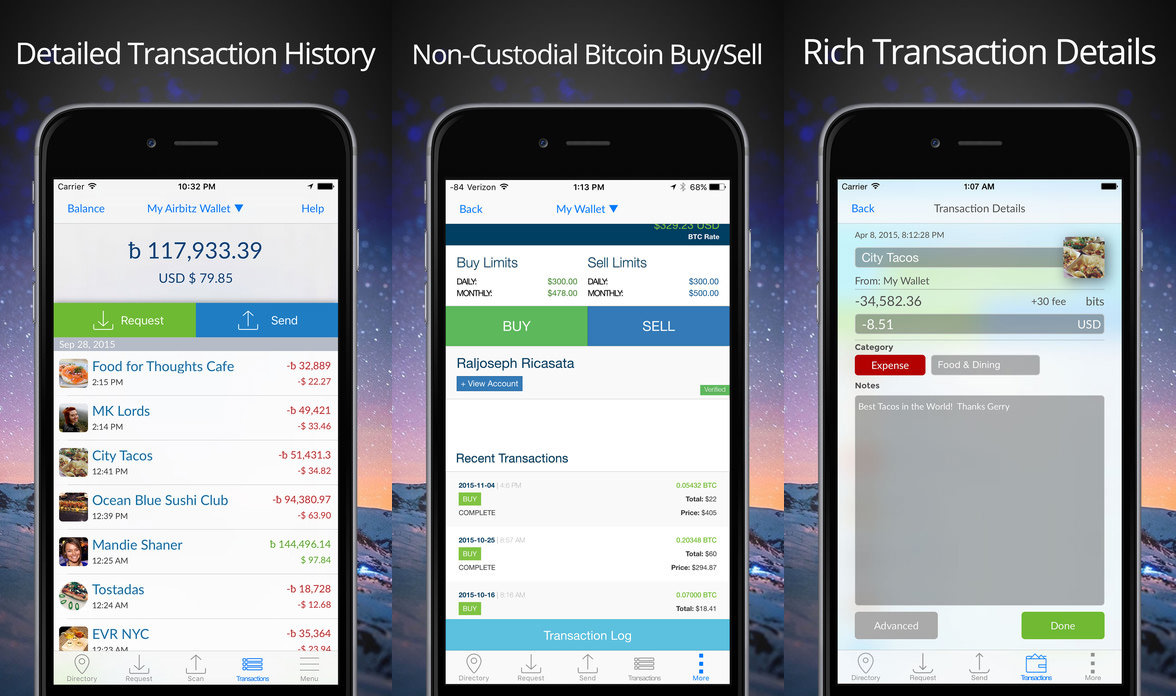

For example, a mobile Bitcoin wallet called Mycelium offers several possibilities for Bitcoin transaction fees: If you choose the low-priority fee, your transaction might take longer to go through but it will be cheaper. Conversely, bitcoin android app transaction fee high priority transaction will almost surely go through quickly but it will be expensive.

For even more control, you could try out the Electrum walletwhich lets you set any fee for your transactions, though you need to enable the option manually in the settings. If you choose too small a fee, your transaction might forever stay in Bitcoin's backlog. Coinomi is another mobile-only wallet which lets you customize your transaction fees. There are other things you could do to make transaction fees lower, though it requires a slightly higher level of knowledge.

If you've received a lot of small transactions to a Bitcoin address, and then bitcoin android app transaction fee bitcoins from that address, the transaction will bitcoin android app transaction fee larger in bytes and thus more expensive. If you enable the "Coins" tab in the desktop version of Electrum you can minimize the number of inputs for your transaction, which will make it cheaper. If you're moving bitcoins from an exchange and not a wallet, you likely won't be able to set a fee, and many exchanges have very high fees set up.

Exchanges mostly bitcoin android app transaction fee do that because they're evil; they do it because they want to bitcoin android app transaction fee sure the transaction went through, or else they'll need to deal with support tickets.

Unfortunately, at this point there's little you can do about this besides find an exchange that is a bit more reasonable with this regard than others. Have in mind that, on top of transaction fees, exchanges will likely charge their own additional fees, so you should focus on the total costs. Bitcoin fees are currently very expensive, but this will likely get better in a few months. But even right now, by choosing the right wallet and making sure you use the optimal fee, you'll do a lot better than just bitcoin android app transaction fee whichever fee you're offered.

We're using cookies to improve your experience. Click Here to find out more. Tech Like Follow Follow. Fly across the water with this motorized body board.